Good morning. Happy Monday. Hope you had a nice weekend.

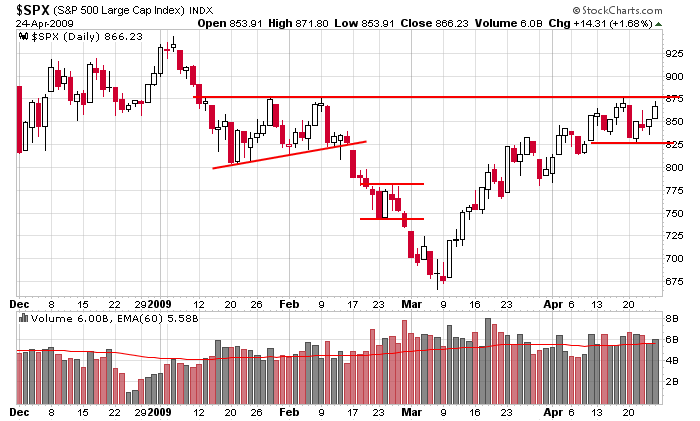

The SPX lost about 3 points last week – its first losing week in seven weeks. We’ll call it a pause week, or just some simple consolidation. The SPX has traded between 825 & 875 for over two weeks; it’s either setting up for a breakout and rally or it’s luring in late-to-the-party bulls that will get crushed on the next leg down. The short term trend is up, and it’s much easier to find continuation breakout set ups, so my bias is to the upside. But with the government so heavily involved in the day to day workings of Wall St. and the economy, we can’t be sure any particular scenario will play out.

Here’s the SPX daily. There’s nothing wrong with this chart, but until resistance is taken out with force, we can’t put all our chips on the table. I personally am keeping trades short term. For seven weeks, every dip has gotten bought, but for some reason, I’m not in a trusting mood these days.

headlines at Yahoo Finance

stocks to watch MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases