Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed up across the board. Hong Kong, Indonesia, Japan and South Korea rallied more than 1%. Europe is up across the board. Austria, France, Germany and Stockholm are up 1% or more. Futures here in the States point towards a positive open for the cash market.

The dollar is down. Oil and copper are up slightly. Gold and silver are up small amounts.

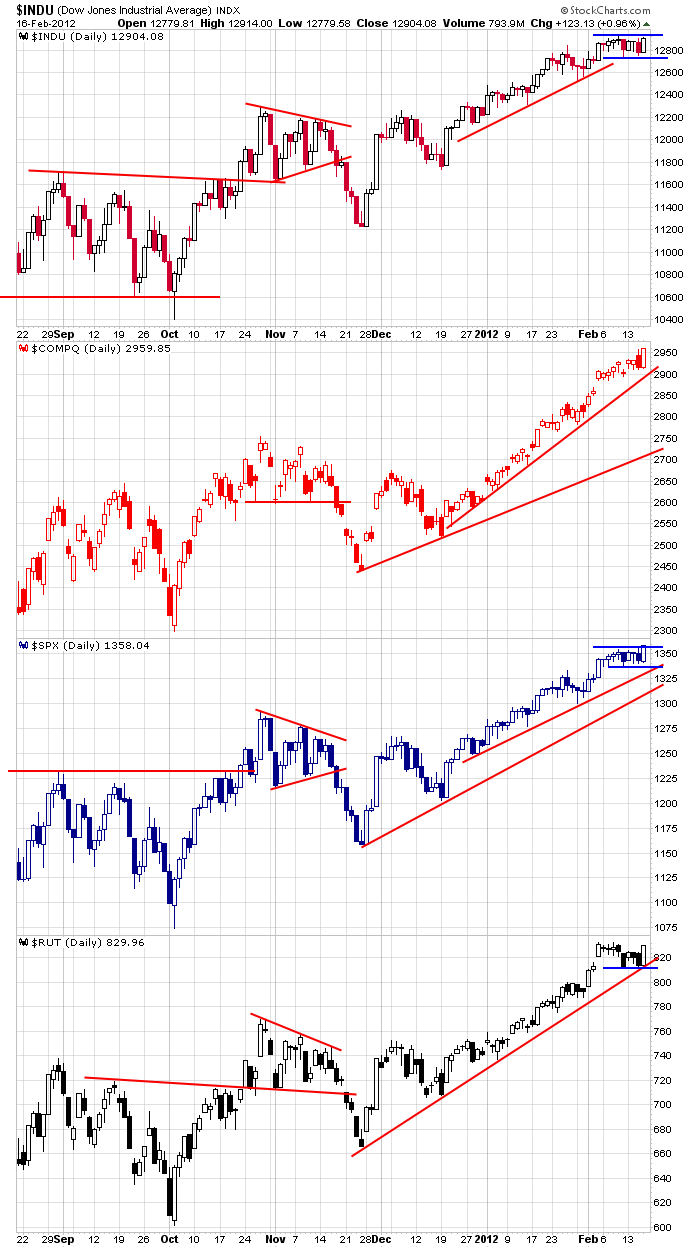

Yesterday the market put in its best up day in a couple weeks. It was solid for both the point gain and also because all the gains took place during regular trading hours. Previous solid up days gapped up and then flat-lined all day. Yesterday opened close to unchanged and then rallied all day – finally a playable trend up day. Here are the index charts. The Nas and S&P closed at new highs. The Dow is nicely set up in a small flag pattern within an uptrend. The Russell has been lagging but acted great yesterday.

The indicators are mixed right now. Heading into this week, they pointed towards a needed correction (from a technical standpoint), but things have started to turn. The AD line and AD volume line have started to curl up, but the PC and new highs still need more time or a pullback to negate their bearish leanings. A solid up day today would go a long way putting most indiators back in bull mode. I posted many very good set ups in yesterday’s PM Obs. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 17)”

Leave a Reply

You must be logged in to post a comment.

with inflowing liquidity now from japan the market keeps distributing

at some point we will get a exhuastion and false break, that point could be today but needs to be in the chart and confirmed

opts ex can be volitile or flat if all the work has been done

Raymond – would you agree that if one were to follow the N. Darvis trading approach, Jason’s INDU chart would show a strong uptrend with INDU now in a “box”, perhaps “like a dancer crouching, ready for the springup”? A thrust to the upside out of that “box” would initiate a buy signal with a stop loss below the lower edge of the box. If that’s correct, you would look for “alpha” stocks setting up in similar fashion to maximize potential profits on a continuation/confirmation of the individual stock’s uptrend. Would that be correct?

Yes, this could be the case. However, I believe consolidation / break models like the Darvas Box and CANSLIM chart patterns are more applicable for individual stocks not so much for indices. Indices because they are a composite of winners, losers and dead beats behave differently. This also goes for the application of Edwards & Magee type TA patterns. Overall the behavior of the indices are like a distraction – beat drums in the East, attack from the West.

The averages only provide an average ‘edge’. I have learned and emphasized in posts the indices basically have too much inertia and are a poor forecaster of alphas stock / ETF performance. They do confirm underlying stock moves but most times after the the move has been in progress for some time and sometimes as the move is ending.

Bottom line, look under the hood. This includes monitoring and considering underlying fundamentals and policy changes that are being confirmed by technicals.

ie –

The automotive groups

UNG BOIL

FIO

etc

This is an alert!

For those who are interested and remember – Neal’s Dow 13,000 T-Shirts are only available in XL size (M & L sizes are sold out and S size was never manufactured). RichE has Neal’s contact info. Be prepared to pay through the nose for this collector’s item.

Bundling toxic assets I am.

By the way, form a technical perspective, when the last T-Shirt is sold you will have a confirming DOW signal!

That would be a DOW sell signal.

forbes magazine front page says dow 15000—lol

there for dji 5000 is a certainty

there is to much bull out there and 13000 not a certainty

curently todays 12950 is the high –im short at 12948 so far for today

infact im short the world so far today –all in good profit

This govt manipulated market reminds me of prohibition. Polititions with their pockets lined with lobyist and kick back gold controlling the public for their own good.

DOW 13000 T-shirts will light-up your TRADING!!!

Lighter not included.

Paid for by the DOW 13000 Super PAC

well we had a chance at DOW 13000 and couldnt make it

there would have been to many bull opts there

cash markets and shares dont run the markets —-derivitives do

and they are run by market maker bookmakers

they take the opposite side to retailers and mutual long onlys

its all a horse race

Geez! gov’ment manipulation, pollitical manipulation, derivities manipulation, Jason manipulation, Aussie manipulation.

Geez. stupidity is blind