Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed; China, Japan and Taiwan rallied about 1%; Singapore dropped 1%. Europe is down across the board. Belgium and Stockholm are down 1%. Futures here in the States point towards a slight negative open for the cash market.

The dollar is up. Oil and copper are flat. Gold and silver are down.

For what it’s worth, Fitch has downgraded Greece into further junk status, from CCC to C, saying a default is highly likely in the near term.

The market has traded quietly for two days. Volume has been light, the ranges small. Normally we’d look for a stiff move down under such circumstances, but shorting a dull market is not a good idea, and right now, shorting in general is not wise. The market is steadily trending up, and traditional analysis techniques have lost their usefulness. The trend will end when it ends, and nobody knows when that will be. It’s best to be long and hold on and not over-analyze things.

I’m serious about this…don’t over analyze. This is the kind of market where a janitor makes more than a college proffessor because the janitor just goes with the flow without questioning anything while the college professor questions everything and misses the move.

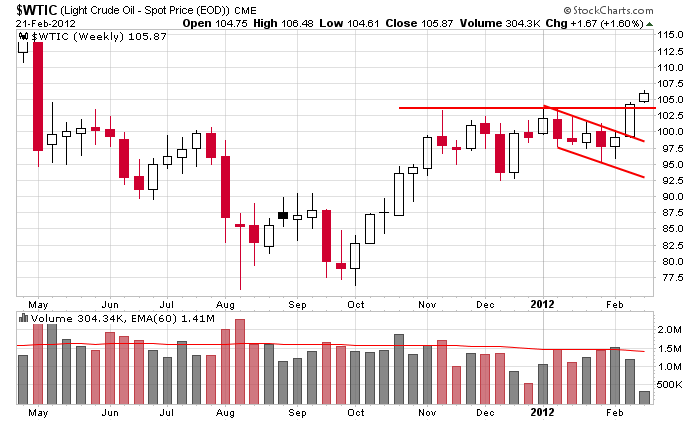

Supposedly gas prices are the highest they’ve ever been at this time of year. I wonder how this will effect consumer spending going forward – especially if they continue to rise into the summer. Here’s the crude oil chart. We got a breakout last week and some follow through yesterday.

More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 22)”

Leave a Reply

You must be logged in to post a comment.

We start a forth wave correction soon for a 3 to 10% correction.

This is an election year so expect outragious stimulation, not clear how, but it comes. EU at best is worth 8% exports to US, so its not about trade.

But no idea how the CDS world is tied into US banks.

No over analysis to be cautious and never

go with the flow is it down. I am not a janitor, yet.

Best. Whidbey

Time to be defensive.

Timing is everything and with that time in (& out) of the mrkt is also a significant factor in building wealth.

This all said, go with the momentum, there is always a trade. Just watch for and analyse if its a long or short term trade.

Best of luck.

Also don’t listen to or try to be an armchair economist. Most are idiots and charlatans that can’t trade worth damn.

Jason, how forward priced is crude oil? Are they pricing in what they think the inventories will be in three or four months? Or,,, is crude again being besieged by those day trading speculators?

No clue. I’m guessing a conflict with Iran may be being priced in…not war, just issues with the Strait of Hormus.

told you housing was to high for AA and copper to be flat. now we find out reports were a lie. what a surprise

Some group rotation

ESH2 2m2d: Me thinks distribution is under foot.

This does not bode well for Greece or the pump-price. Farewell Greece, farewell SUV.

Com’on market! Daddy needs a brand new 100mpg SUV.

dow 13000 was only because of london–the bigest financial con house in the world

i dont think –im a daytrader–i just look and observe

watch for sector rotation out of tech–dax ect

opts ex in europe/asia /oz this week

Closing half my short.

May take a few more days to break down. Still lots of strength

A few days! Geez.

Could be just a minor pullback, transition to sideways mrkts for a while then a dcsn on more up or and stronger pullback.

If youre a seasonality type and believe the election year profile we keep grinding up higher into 3rd qtr with only minor pullbacks. Then a sell off.

Re: election year profile

It’s working so far.

the feds proping up the market trying to avoid a global financial meltdown idiots

So? use it, make money.

Are you saying I’m an idiot?

no just dont get distracted by the noise focus on the money

Not you Raymond, Russ made the idiot stmt.

GDX & NUGT, not done yet

Look for a trend change confirmation in UNG & BOIL. Today was the 1:4 reverse split on UNG. Should make the shorts happy.

And others…..

If youre a gold bug GLD DGP

Trend changed in late Jan confirmed yesterday

Ditto for GDX NUGT

USO BNO & UCO changed in mid Oct confirmed 3 days ago

UNG & BOIL en route..

As the great Dan Zanger once said – I have never made any real money following the indices

Dont be a sucker, put in the work, you will be rewarded

Beat drums in the East, attack from the West – thats what TGH (The Great Humiliator, the true name for the mrkts) does to us dumb money.

And why the real slick cons of web want you to play the futures. It’s so easy, just have to watch one thing, can make boat loads of money. Just need mega leverage and trade all the time…gee really ok, I’ll bend over, I sure am goin to enjoy this, so much fun…yup

Don’t be a sucker

Best of luck

Raymond – thanks for your mention of N. Darvas awhile back. I read up on some of his work and made note of the following: “…I made up my mind to keep watching the DJIA, but only in order to determine whether I was in a strong or a weak market. This I did because I realized that a general market cycle influences almost every stock. the main cycles like a bear or a bull market usually creep into the majority of them.”

I’ll take a look at Dan Zanger next. Thanks againfor your contributions to the commentary.

Dont just read his books, read up on every article you can get and understand how his mind worked.

The Darvas of our time is Dan Zanger imho.

Also, Darvas was educated as an economist but never practiced the black art.

Almost all economists, esp those, that yap on the public stage, are bleeping bleep heads.

From an EW perspective, there’s nothing apparent that would lead one to think an important top has been achieved. The indexes, IMO, are either completing wave 3 (my preference) of C or perhaps are in the early stages of wave 4 of C. Fibo relationships continue to point to SPX 1375+/- 5 points as a wave C target before a meaningful sell off. My focus is on the 20 day EMA (SPX 1340ish) A close below that level would be an indication that wave 3 is completed and wave 4 is in progress. In terms of time, the cycles (from what I can tell) are pointing to next week on out to late MAR for an important top, with the last week of FEB/1st week of MAR as the most likely time frame. Because of the upward grind in progress, I favor an “ending diagonal” wave 5 pattern to complete wave C.

But who cares? For me, it’s not a favorable environment to trade, long or short at this level. I’m not interested in day trading here, so I’d look for signs of a wave 4 bottom to enter long or wait longer for signs of a significant reversal that would suggest wave C has been completed.

Pete, If I say there’s a neg div of the rsi on the nasdaq, do you know what I mean? If not I will show you if you post your email addrss. Basicaly we are WAYYYY over bought and due for a pull back. The fed will let it happen when they feel it’s safe to let it happen. You can play, but I would not hold overnight and do use tight stops. When the music stops, I’m already setting down 🙂

Russ – I see negative daily RSI divergences on all the indexes so I understand your concern. But, the weekly RSIs on the indexes are not overbought, much less showing negative divergences. So, allowing for a pullback based on the daily charts, I still think there’s more upside and I wouldn’t (as Jason said) short this market. As I mentioned, I’m neither long or short at this time but would consider a long position on what I see as a wave 4 pullback to a support area.

Where are you putting support?

RichE – If the 20 day EMA is taken out, I’d key on the 50 day EMA (currently at 1307ish and rising. But, I’d also consider the wave structure of what I’d perceive to be wave 4 in conjunction with the 50 day EMA and the trendline connecting the OCT & DEC lows. Unfortunately I can’t be more specific than that.

1335, 1320, 1300.

Looks about right. So, if/when we see those levels, I’ll see if it coincides with a corrective wave pattern that looks to be completing and look for an entry point with a logical low risk stop loss.

1350-1420 resistance. If it punches through that I’ll become a swinger. May even read a book on EW.

was a day and not even a single share was traded—what a bore

bring back the manipulators—i need volitility

Be careful of being too dependent on oscillators and other indicators. An RSI with different periods 4 6 16 32 etc indicate different things.

This said from a CANSLIM perspective we may be seeing our 5th distribution day within 3 wks – a reason for concern. But there are still new and refreshed leaders so it may be some time before a pullback. And this said, many excellent technicians like Tom Bulkowski have tested and discounted the distribution day indication.

It is during pullbacks, corrections and chop that true leaders show their muscle – so put in the work and look for them.

the rsi on a yearly of the nas is 68 and dropping. I am in and out AA long and PHM short. Alcoa is telling the truth, and it says $10.37. Homebuilders are misplaced hope. Buy fear and sell hope… until things improve

notice how price is being held exactly at ftse-dax closing prices

Predictability breeds complacency. Volatility and volume seem pretty low. Don’t fight the trend appears to be the mantra of the day. I’m sitting on the sidelines waiting for signs of a turn. No, I’m not going to play the ending wave of a C. PeteM, if you get what you want, it will be short and sharp, exciting many and the buyers may find themselves committed to long positions that they no longer want.

Brian – right your are!

Consider all the opinions expressed today. Everyone applying their own favored technical analysis to whatever time frame they’re trading. But in the end, there’s no holy grail. I’ve traded/invested for over 40 years and what’s allowed me to survive and achieve some success is cutting losses short and catching the longer term trend. But, sometimes I lose my discipline, get stubborn or fall prey to a bias and I get shocked back to my senses! Reading the comments of others here helps me to clarify my thoughts, so I thank you all.

the markets are under the control of the MI5 and james bond 007 is running the opperations

Aussie opts ex today thurs

I have a theory that the reduction of prop trading is changing the texture of the mrkt.

I also believe that the lasse faire BS Chris Cox, ex-SEC honcho allowed to happen during his watch being cleaned up.

I do not see mrkt making and volume going away, I do see some more unusual and yet somewhat predictable price behaviour developing. Volume analysis is still a cluster bleep.

All traders need to research and use only the appropriate tools in the tool box. This may take a bit of time and include both TA and FA.

I love volume, long nicks, and tails.

volitility is low because it’s being smoothed by the fed, and thats why there’s no volume. Fed can print more than WS can throw at the market. Have no doubt who is in control of this market

Geez! gov’ment manipulation, pollitical manipulation, derivities manipulation, Jason manipulation, Aussie manipulation. Are you saying I’m an idiot?

sorry to harsh

naive

ref:having or showing unaffected simplicity of nature or unsophisticated