Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down, but only South Korea dropped 1%. Europe is currently mixed; there are no 1% movers. Futures here in the States point towards a flat open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

The market keeps chugging along. It’s been hard to trade the indexes because instead of getting a couple steps forward and then a step back, we’re getting baby steps forward almost every day. The day to day movement hasn’t always been easy to work with because we’ve gotten lost of gaps and the intraday ranges have been small, but the net change over time is effective. It’s been a market you want to buy and hold rather than constantly trade in and out of. But if you trade individual stocks, it’s been business as usual. The significantly reduced correlation has resulted in obvious outliers to trade. We’ve had lots of good breakouts, lots of good follow through and a steady wind at our backs. As long as you recognized the trend has been up and you played the better stocks from the leading groups, profits have been easier to come by than last year.

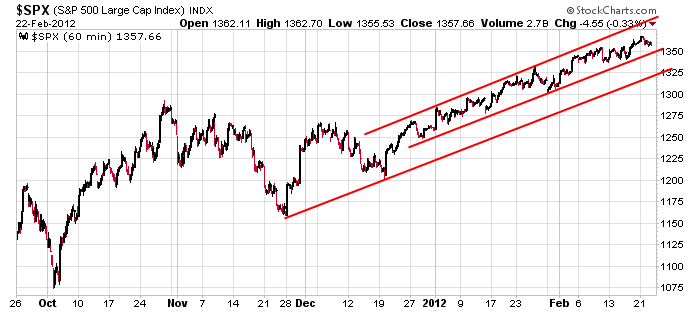

Here’s the 60-min SPX chart…it doesn’t get much steadier than this. The trend will end when it ends, and it’s best not to guess. Don’t be one of those negative cynical people who says: “the market can’t go much higher because (fill in the blank).” Sometimes you gotta turn your brain off and just go with the flow. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 23)”

Leave a Reply

You must be logged in to post a comment.

Look for continued weakness. Leaders still strong but need to reassess by ftse & dax close.

Good luck.

Defensives are still holding up, accelerating perhaps

Fat ass stocks are rocking WTW HLF VVUS 😉

BIDU ww again

How about some input, at least some insights into sectors and industry groups.

Discussions about the indices, waves, levels etc is pretty useless.

Been watching the Hotels lately. LVS, HOT MGM, have all gone up over two months. Looking for a drop due to bearish techs.

perhaps just a pullback, MPEL ww

For anyone who still doubts, Fischer said this morning, the fed is still buying mortgage backed securities.

WS likes to run the market up into month end to make sure joe sixpack pays top dollar for his first of month contribution 401krap sandwich. The fed will sell into this to give shares to WS and give joe a better price and encouragement.

indeed, rich is one of the sensible ones, tho a ex wall steeter

also his comments on the volkr rule and brk up of the fat ass banks is encouraging.

shld be bullish in the intermediate / long term.

now to address the bleeped up mess that foll chris cox made during his tenure as sec head. he did some good prior to his sec days but as head of the sec, perhaps influenced by unregulate everything bleep suckers summers and greenspan, he added gasoline to the bank scam fire storm.

bought some aa 10.30 and will sell some @ 10.46. same thing I did yesterday

ABC ww

Starting to confirm trend change

FIO may be at add in lvls

TJX starting its parabolic run

TQQQ TYH popping

UNG BOIL still ww, may take more time to confirm or reject a trend change

Need some input into groups and stocks

Just commenting on the indices as you can see is pretty useless. Unless you like gambling with max leveraged futures.

took some profit on aa. what would you guys like to drink

homebuilder stock traders are ramping into new home sales numbers due out. They will squeeze the shorts even if the news is disappointing. Jesse Livermore said it’s not enough to be right (short). You have to be right at the right time.

better check the short interest, price vol behavior and growth / fundy numbers in those stocks if you think you see a squeeze. put the odds on your side.

isrg over the yrs was an excellent sqz play one of my big money makers on both the long and short term swing. great fundys & technicals and short interest approaching high 20% at one pt. when cramer and the other media charltns yapped negatively about it i loaded up on full margin for a +40% (+80% margin) run.

best of luck.

we are coming to the top of the range in the indices and some sectors, watch for weakness or a break through

lightening up on NUGT, will look for a pullback add

ditto for tyh tqqq

God it will feel good when this dead horse gets back on it’s feet!

ditto for bno uso uco

trying a BOIL re entry

May take more time to resolve the trend

adding to AON

Doesn’t sound like you trust shorting right now Ray. You ever make pairs trades?

No, I have learned from a very accomplished but unknown retail trader as well as by studying audited super traders of our time (Zanger, Kacher, Morales, etc) not to bet against myself. These guys trade asymmetrically, trade with the primary trend. Thats where how the big money is made. Of course if you are wrong and keep your position too big for too long it does make your eqty curve swing wildly.

And I do not have access to powerful enough tools to show me with certainty what pairs are correlated / not correlated to make such a strategy work. Frankly the only guys making money on such a strategy seems to be the people selling the a pairs trade option strategy. I am busy enough as it is, I try to filter out the noise, wait and hunt down the big movers.

But I do take opportunistic profits on mover stocks and ETFs while my longer term holds consolidate. I always keep a cash reserve to take quite rape and pillage raid on a mover both to the long and short side. These are mostly overnight hold – several day trades, in most cases not day trades.

But I am always open to learn. And quick to turf stuff that does not work or is just BS.

ESH2 10d5m: critical mass approachest. Feb 17th, 1360 is that gap’s window sill. Will the returning lunch bunch be bears or bulls? Stay tuned or watch the film at 11.

bet we visit the 20dema on the sp within 4 trading days Rich

1340,1320,1300

apparently the boys have nodded off. that will teach them not set in the sun

Yep, that’s so they can get up early and play with the Brits. Tomorrow’s pre should be volatile. Damn! I hate getting up early.

Sold some FIO, nice $20k pop day, continuing to build a longer swing

will dig the spurs in if we clear ovr hd rstance

On the 6 mo daily, FIO broke the down trend a wk ago, made an IPO u turn and formed a dbbl bttm now trying to breach 30ish.

How about some participation / collaboration, getting a bit tiresome again.

Leaders still strong, more leadership rotation, not much of a pullback

Some strong buying, watch the last 30m close.

no one wants to play superman and step in front of this 13,000 pile of crapwagon

YNDX may have finished its pullback from break out levels

Here is a thought – what if

1)

Prop and high frequency trading is banned by statutory law and made hugely unprofitable by administrative means. Not just in the States but everywhere.

2)

The uptick rule comes back. Thanks Chris Cox for lifting that for your buddies just a few months before the big dump in 2007

3)

World governments / Feds, who doled out welfare to the bleep head banks want their money back, how does one do that? They are have / are in the process of fencing in parasitic fees. How do they get their money back, populations are growing, they need a growing tax base. By more shorting? By …..???

4)

Have the media and pundit bleep heads been right most of the time? How do they make money? Maybe they are just plain stupid or manipulative for their own means? Are all companies and their businesses a sham, way overvalued? All propped up by the evil Feds?

Where is the money making upside for the big banks with their close communication to the mrkt (ie front running) computers? Is it on the short side? Is it better to basket / program trade with stock rotation while keeping under the radar of any high frequency trading prop trading criteria?

Supposedly the big banks are already disbanding their prop trading groups, yet they still have the hardware. They are still involved in mutual / hedge fund execution support. Now will VWAP still be a execution / mrkt making performance criteria? Or will ultimate return be it short term or long term be the criteria? What would you do?

A very big hmmmmm

But it could just be one of my many dillusions.

problem is polititions are in bed with the banks. Look at AIG

cnbc? they brag about ibm at 200, but don’t mention the money came from hpq flaming ship jumpers. meg says printer ink sales show economy sucks and is going to suck worse, but cnbc brags about ibm like it’s good news. what a crock of s#it

Folks, who cares, so what. Just use it to make money.

Its OK to hear, even take a good sniff of the BS but don’t eat it. Test everything against facts and what is actually happening, not what we think or those bleep heads think should be happening.

Tomorrow will tell us if the recent distribution days are to be discounted or if we need to raise more cash.

All the best.