Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Hong Kong, Indonesia and South Korea rallied more than 1%. Europe is currently trading mostly down. Austria is up 1.7% and Amsterdam is down 1.2%. France, Germany and London are down. Futures here in the States point towards negative open for the cash market.

The dollar is up slightly. Oil and copper are down. Gold and silver are down.

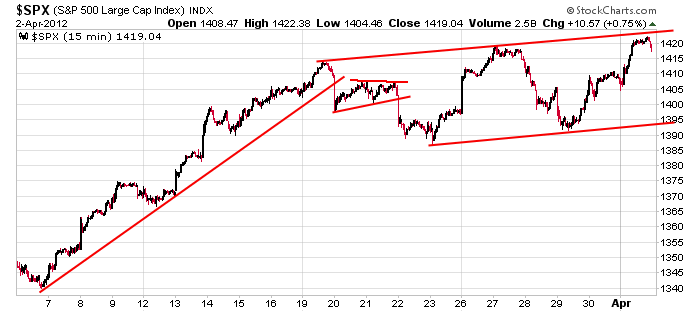

Here’s an update of the 15-min SPX chart I posted yesterday. The index tested the top of its pattern and hit a higher high. When the week began I was thinking that with the employment numbers coming out Friday and earnings season kicking off next week we’d get a continuation of the range we’ve been in. If indeed this is going to happen, the bears need to step up and push prices down because they’re dangerously close to ramping up from here.

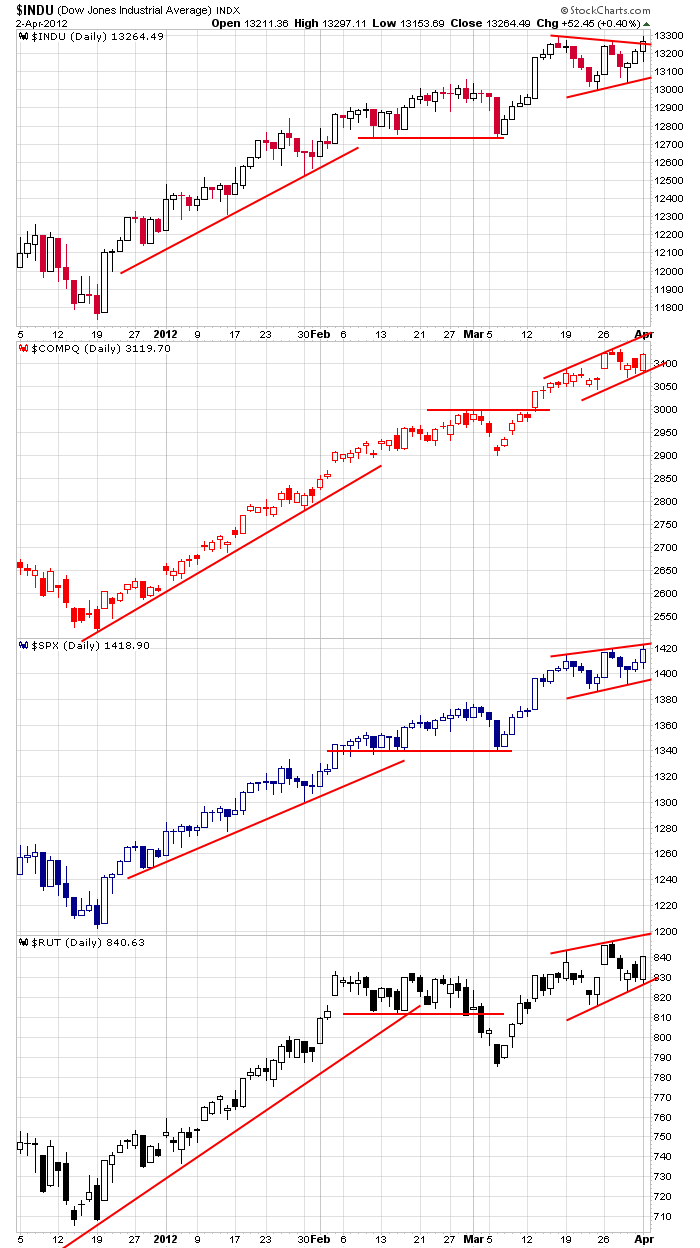

Overall things continue to look very good. Here’s an update of the daily index charts. The Dow is trying to break out from a symmetrical triangle pattern. The Nasdaq and Russell moved nicely off support yesterday. The S&P tested resistance and closed at a new high.

Today may set the stage for the rest of the week. If the market doesn’t move up, odds favor the range continuing because things will slow quickly – it usually happens into a long holiday weekend (the market is closed Friday). But if the indexes move up, it wouldn’t take much for them to get squeezed higher for a couple days. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 3)”

Leave a Reply

You must be logged in to post a comment.

D…..R….A…A….A….A…G….I….I….I….T….O….O….O….U….U….T UNTIL THE ECONOMY RECOVERS. Who knows, we may never see a free market again

No free market? Yeah! No more PIGS! No more speculators! No more AIG! No more Jennifer Westhoven? Boo!

ESM12: 1402 then 1397 then 1387

1407 then 1406 then 1407

you gettin a good look at your pig Rich? she’s on your screen right in front of you. got her lipstick on. waitin for a big ol smooch

Russ,

You don’t have to keep up with me.

you like h/s patterns. look at a 5 day of AA

one day it will get to zero ,then it will be free

don’t throw your currency away. you can use it to light your woodstove

Yo, Brian – Hope the pinot noir/chardonnay was good on your wine country visit!

I’m watching SPX. From an EW perspective, the ED pattern is gaining some increasing potential, IMO. That could be a grinding upward pattern to the 1440 area (the MAY 2008 high as we enter earnings season. In the meantime, the upward trendline from the DEC low defines the trend.

RFLMAO

It could come down some more tomorrow. they just don’t want it comming down to fast. smooooooth. It would be great to see the vxo break through the 50dma. I imagine they want to keep it up until they get some news they can spin positive. I’m thinkin jobs?

fed bastards got the VXO back below the 50 I’ll be damned

where’s jason? watchin mad money?