Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

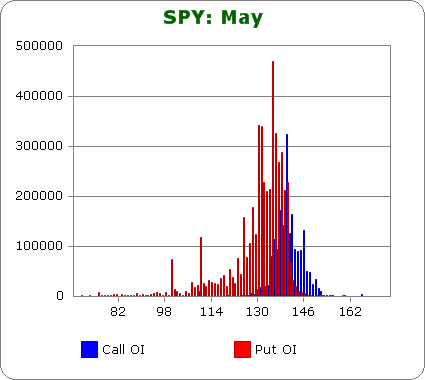

SPY (closed 134.11)

Puts out-number calls 2.3-to-1.0 – slightly less bearish than last month.

Call OI is highest between 136 & 146.

Put OI is highest between 125 & 140.

There’s ovelap between 136 and 140, and it’s noteable the call strike with the greatest open-interest is also the top of the high OI put zone (140). Puts out-number calls, so a close between 138 and 140 would cause the most pain. With today’s close at 134.11, the market would have to rally to accomplish this. As of now, some of those higher-striked put buyers will make money.

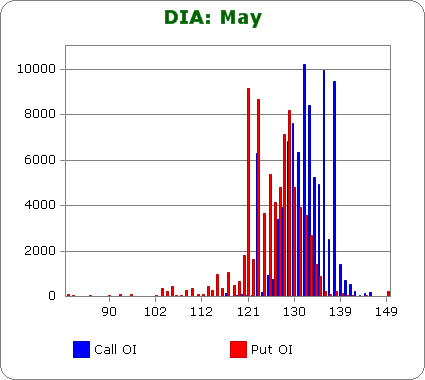

DIA (closed 126.95)

Puts and calls are about equal – much less bearish than last month.

Call OI is highest at 123 and between 129 & 133.

Put OI is highest at 121, 123 and between 125 & 130.

These numbers don’t matter because DIA call OI (~ 175K contracts) is so much less than SPY OI (~ 4 million). Nevertheless, these numbers suggest a close around 129/130 is needed to cause a lot of pain (although it’s hard to say where max pain is). DIA closed at 126.95 today, so a move up is needed.

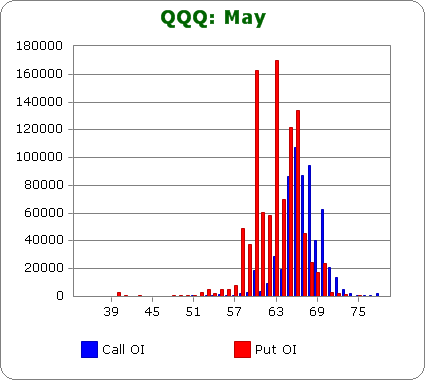

QQQ (closed 63.58)

Puts out-number calls 1.2-to-1.0 – less bearish than last month.

Call OI is highest between 65 & 70.

Put OI is highest at 60 and between 63 & 66.

Put and call OI are about equal, and there’s clear overlap at 65/66. Hence a close there would cause the most pain. Today’s close was at 63.58, so a move up is needed.

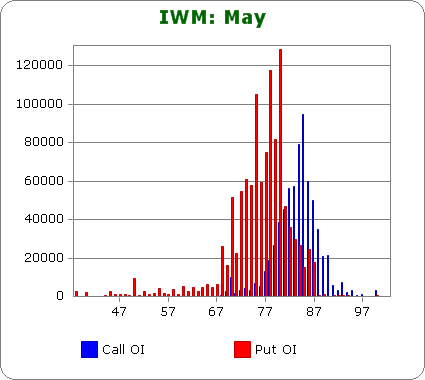

IWM (closed 77.85)

Puts out-number calls 2.0-to-1.0 – the same bearishness as last month.

Call OI is highest at 85, and it tapers off in both directions for several strikes.

Put OI is highest between 75 & 80 and a couple strikes below 75.

Instead of overlap, there’s two distinct zones, so picking the max pain strike is easy – the one in the middle, which is ~ 81. IWM closed at 77.85 today, so a move up is needed.

Overall Conclusion: The bears again bet on a market drop, and as of now, they’ll make some decent coin. In all cases above, the market would need to rally – in some cases several % – to cause max pain. Congrats to the bears.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

has anyone every done a study as to what percent near max pain the market closes. Or what percent of the time is max pain closing price achieved.

Most of the time, whatever movement is needed to cause max pain has already taken place by the Monday before expiration.

Personally I would not trade off this info. It’s nice to keep in the back of your mind, but not good enough to use.

Jason

Excellent question

If the market goes down much further this week I’ll be suffering some pain.

Open your wallets fellas and run the spy back up a few points.

I’m sorry to have to ask you guys to do this but I cannot count on JPM to do this for me this week. On the the other hand GS may throw in some tax payer money and get the job done. Or uncle Ben might print some cash and give to the banks for them to drive the market up a few points.

are these max. pain numbers(138-140 spy) the same as on Monday or lower?