Good morning. Happy Wednesday.

The Asian/Pacific markets closed down across the board. Hong Kong and South Korea dropped more than 3%, Australia and Taiwan more than 2%, China, India, Indonesia, Malaysia, Japan and Singapore more than 1%. Europe is currently mostly down. France is up 1%, Belgium and Stockholm down more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is flat. Oil and copper are down. So are gold and silver.

The market is in the midst of quite a trend. The dollar has moved up 12 straght days. Gold has moved down 9 of 11 days, oil 9 of 10 days, copper 8 of 10, the Dow 9 of 10, the S&P 8 of 10, the Nas 7 of 9 and the Russell 7 of 9. Every day the bulls are able to push prices a little higher, but overall it new low after new low. In fact the S&P has taken out it previous day’s low 9 of the last 10 days. Anyone who has remained bullish and hoped for one last bounce to exit positions is feeling a lot of pain right now.

In January, February and March, neither the technicals nor the news mattered. The market just went up and up and up regardless of what was thrown in its path. Now the opposite is taking place. Nothing matters. The market is going down and down and down.

The most bullish thing I can say about the market right now is that it’s been downright nasty, and the bears are coming out of the woodwords. Lots of people are predicting much lower prices. Sentiment is at a very low level – a condition for a surprise move up.

We’re going to get lot so housing data today before the open, and then we’ll get FOMC minutes this afternoon. The last Fed meeting was three weeks ago – well before the calendar flipped to May and the selling pressure began. Hence I don’t expect there’ll be much talk about QE3 – at least not any more than what has taken place the last couple months.

Yesterday Facebook increased the range of its IPO; today it’s increasing the size by 25%. Now they may raise upwards of $16 billion. That money has to come from somewhere. M&A activity is good for the market – it reduces the total float. IPOs are bad – they increase the float.

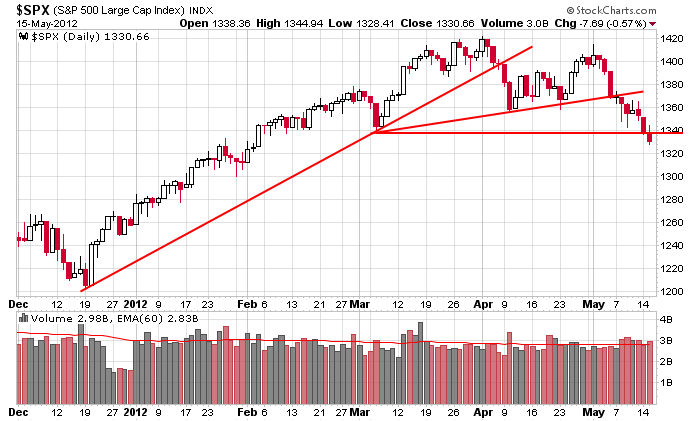

Here’s the daily S&P I posted yesterday. It’s not a good sign when the third trendline is broken. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 16)”

Leave a Reply

You must be logged in to post a comment.

1328.5. close enough

ACI continues to be a good trader. bought at 7.66 and sold at 7.90 and 8.01 in 30 min.

maybe it will go back down to 7.78 and we can try it again

damn I forgot to try and figure out some sort of wave pattern again! you still got my money aaron? you can cash that check friday LMAO. don’t forget to call craphead cramer tonight and find out what already happened today.

Russ, your killing it with ACI. Congrats!

I’ve got your money if you bought my $RUT puts and calls. I’m confident both will expire worthess.

I’ve got your money if you bought my SPY calls.

I have your money if you bought my SPY puts for now; however, if the market drops then you win and I lose. I could buy them back today to minimize any loss or I can let it ride until Fridays close. I bought lower strike priced puts on the SPY as my stop loss.

ACI down to 7.81 and still comming.

bought some ACI

7.78. how the hell did I do that?

nas sitting on the july 2011 high plus feb 2012 gap. I really thought we’d have more support here.

A lot of eyes will be on AMAT report after the close tomorrow

bought aci 7.57 save me ben save me tom cruise save me oprah

sold some 7.83 3 1/2% 60 min

damn it forgot to look for waves again before I sold

they apparently didn’t want it after all they sold it back to me for 7.61 after hrs

semis fall from 440 to 380 and are now sitting exactly on a 8 month trendline. So this

jp morgan so called analyst down grades the whole sector TODAY? Remember This

Christopher Blansett of J.P. Morgan downgraded the three stocks to underweight, or the equivalent of sell. In a note to clients, the analyst predicted “a downtick” in capital expenditures by chip foundries in the second half of the year, and that capital spending in the memory and logic sectors of the business will be lower than many investors expect.

http://stockcharts.com/h-sc/ui?s=$SOX&p=D&yr=1&mn=0&dy=0&id=p95262462501&a=44640932&listNum=2