Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up. Indonesia dropped 1%; South Korea rallied 1%. Europe is currently mostly up. Belgium is down 1.4%; Austria, Germany, Norway and Stockholm are up 1% or more. Futures here in the States point towards moderate gap up open for the cash market.

The dollar is flat. Oil and copper are up a small amount. Gold and silver are down.

Leaders of the G8 meet at Camp David this weekend, but they didn’t make any newsworthy announcements.

Yahoo is selling half its stake in Alibaba for $7.1 billion and then increasing its share buyback by $5 billion.

Lowe’s lowered its full year guidance by 2 cents.

Bloomberg is reporting the guy who oversaw risks in the JP Morgan unit that lost more than $2 billion was fired in 2007 by Canter Fitzgerald for money-losing bets that caused a regulatory santion against the firm. lol

The NYT is reporting Barclays is selling its $6.1 billion stake in Blackrock.

The market is in pretty bad shape right now, so in a twisted way, it may be close to a tradable bottom. That’s how Wall St. works. Once a downtrend begins, it’s better to get a complete washout before attempting to rally. There are many breadth indicators that are at an extreme level. If the market bounced here, it would be supported by a long list of technical indicators. But unfortunately news from Europe is dominating. Bad news regarding Greece and Spain will quickly push the market down. Good news could easily induce buying for several days or longer.

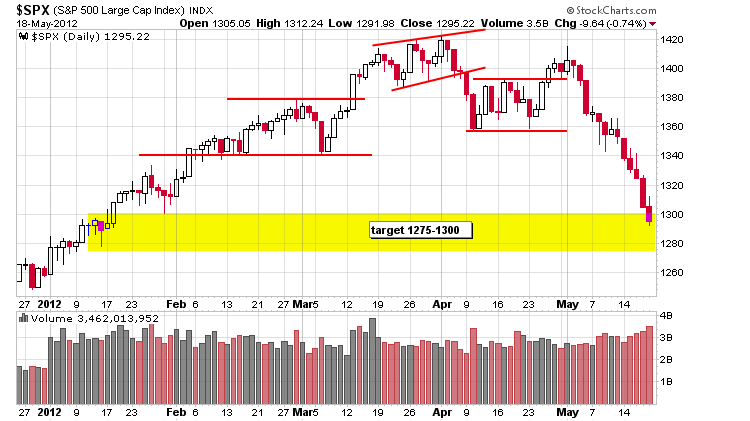

Here’s an update of the daily S&P chart I posted a couple weeks ago when I established 1275-1300 as my downside target.

The risk/reward for entering new shorts is not good right now. Be defensive. The biggest up days occur within downtrends, so even an innocent 2-3 day bounce could push the indexes up 5%, and that means many stocks can move 10% or more. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 21)”

Leave a Reply

You must be logged in to post a comment.

ACI continues to trade very well today. 7.22 to 7.50 in the first 20 min.

LOL

last monday i asked for everyones help to push the market up whilst i was away

now look what happened—we had a bear t/over to squeeze those nasty retailer longs

for opts ex fri–instos always take the opposite side to those funny retailers

i missed some wonderfull short trading

now im going to have to change my whole personality –to become cheif sitting bull and think long

a inside day of consolidation today–so could go either way tomorrow

maybe i could still be cheif crazy horse of the bears

but maybe it will become a elliott waveist and start wave 2 up of large wave 3

or is that wave 5 up of 2

anyhow i need some bull to short

hahaha oh God not with the waves again! where is little peter? I think I hurt his

little feelers. he said he would fight no more forever, and bid everyone sweet farewell

and god made waves of bull and waves of bear

well pray to God for Christs sake a bear please. AMAT up 2 1/2 and ACI up 7 1/2 and I would like to reload

HEY! WAKE UP! YOUR DAMN WAVES ARE BACKWARDS! YOU MUST BE LOOKING AT THE SOUTH POLE!

We are the debit borg, resistance is futile.

whos we paleface

Jeri Ryan

ah yes 7 of 9 + 2 lovely topedos

ummm torpedos. my tongues hard

Friday, was ugly.

I had roll my SPY put 131 into June and just buy back my SPY put 130 position.

All of my SPY calls were profitable.

All of my RUT calls and puts were profitable.

As for my two common stock positions.

JASO – hammered down with the trade commisions ruling to impose a 39+% tariff on Chinese solar products imported into the US. In my opinion this is an immediate knee jerk reaction. The chinese will work around this tariff. For example, build in China, ship to Taiwan, relabel made in Taiwan, ship to US, and bingo no tariff. I’m down; however, I buying more.

WGO – Getting whipsawed with possible buy out news. I’m staying short.

Gruesome and Awesome –my 2 dead cats are refusing to bounce

they say they have retired

LOL

is china going to rally the euro

USD way overbought. when it comes down my AA goes up

I guess the fb social lemmings didn’t think their ws shit sandwich tasted very well lol