Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly down. China and South Korea dropped more than 1%. Europe is currently down across the board. Greece is down almost 5%, Austria 3% and Belgium, France, Germany, Stockholm, Switzerland and the Czech Republic more than 1%. Futures here in the States point towards a big gap down for the cash market.

The dollar is up. Oil is down, copper flat. Gold and silver are down.

There isn’t much news out this morning, and there isn’t much (just New Home Sales) on the calendar here in the US.

There’s an EU summit this week, but expectations are quickly dropping anything meaningful will be done. It was origianally believed decisions would be made regarding Greece, who was hoping to ease the conditions of its bailout.

Spain has officially requested a $125 billion bailout from the 17-member EU to recapitalize its banks. Some believe this is just the beginning, that they’ll need a full bailout at a later date.

RIMM is considering spliting itself in two.

BMY and PFE are down before the open. Their blood clot preventer failed to win approval from US health regulators.

The market absorbed two major events last week, first the Greek election, then the FOMC meeting. Then prices fell hard on Thursday in one of the worst days in of the year. A bounce Friday will prove to be short lived because all the gains will be given back at today’s open. For the week, the indexes formed semi ugly candles.

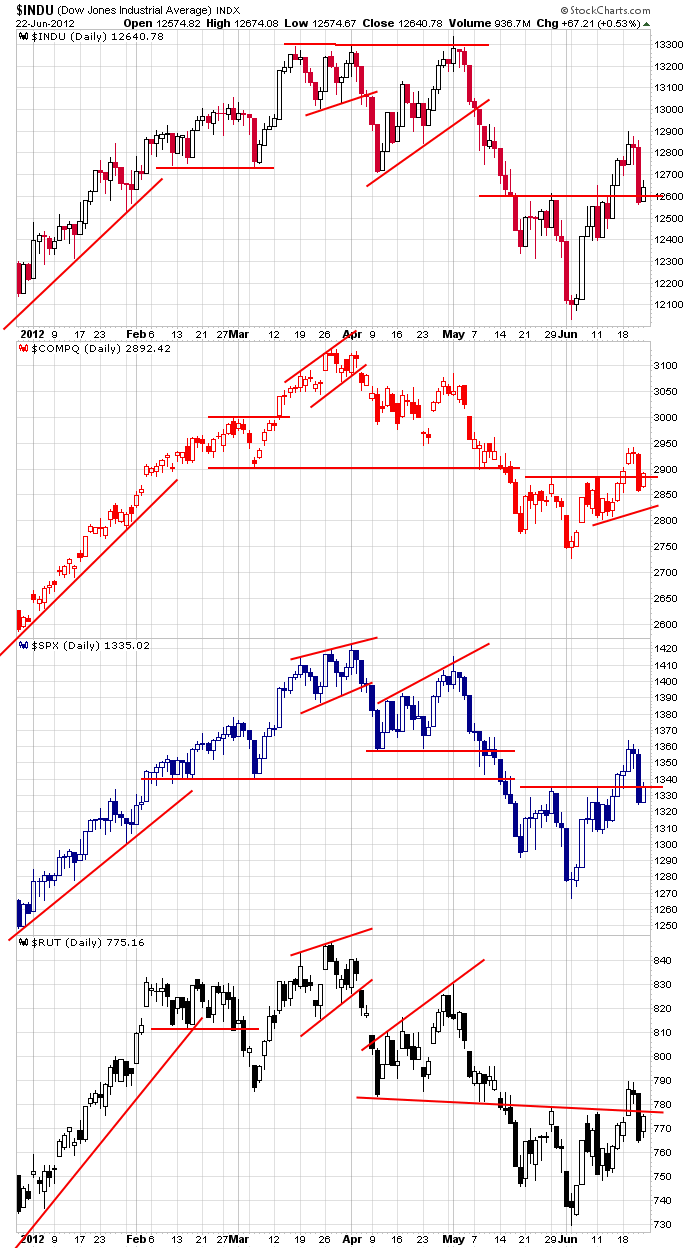

One by one the indexes broke above their 5-week basis but in all cases, dropped below resistance last Thursday, and as of today’s open, they’ll still be below the previous resistance levels. The breakouts will either be of the false variety (lure everyone in and then smack it down) or last Thursday and today’s open will prove to be ordinary corrections within a newly formed uptrend.

There are lots of questions out there, lots of uncertainty. From a trading standpoint, we need to be patient. During the S&P’s 100 point bounce, we had a nice round of trades, but since last Tuesday, we’ve adobted a defensive posture and played good defense. That’s how swing trading works. You get a nice round of breakouts that lasts a few weeks (or longer), then you shift to protect profits and wait for the charts to reset. The fact that the near term is unclear is fine with me because I don’t have any very good set ups to trade anyways.

Here are the dailies. The market needs to make a decision soon. More after the open

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 25)”

Leave a Reply

You must be logged in to post a comment.

just for shts and giggles look at the last 5 days of june last yr

distribution–tax loss selling for some parts of world

but if there is to be no inflowing liquidity from a europe ecb ect opium fix

then a large merkel wave down would happen

uncle ben is a hen

some late buying is happening but not enough to push up conditions

slowed down drawn out and propped up sp down exactly 1 1/2%

uncle ben is doing the twist so as to take out chinas interest and when the time comes for china to drop the usd ,then the fed will owe less

uncle ben has sold out usd and usa

be afraid of managed etf’s –mutual funds unable to beat the market have moved into managed etf’s to manipulate and take your fees

global finnacial system is collapsing and dows down 100. if this market wasn’t being controlled we’d be down 600 today

comments lately are sooo Boring…..