Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Hong Kong, Indonesia, Singapore and Taiwan rallied more than 1%. Europe is currently up across the board (except for Greece); Norway is the only 1% winner. Futures here in the States are flat.

The dollar is flat. Oil and copper are posting solid gains. Gold and silver are posting solid gains.

Today is a half day; the market closes at 1:00 pm EST. Tomorrow is a day off for the 4th of July. Then Thursday is the day before the latest employment numbers are released. Today will be slow, and Thursday may be slow too once the pent up energy from the previous day-and-a-half dissipates.

China’s services PMI jumped to 56.7 in June (from 55.2 in May); this is a 3-month high. This is most likely what is causing commodities to be strong this morning. China is a big consumer of commodities, and if their economy slows and they cut back on purchases, commodity prices fall, but if their economy is healthy and expanding, commodity prices move up. Yes the US dollar matters, but China matters a lot too.

Yesterday the market shook off a low ISM number and rallied again to add to its Friday’s gains. The indexes are now either at new higher highs or very close to it. It’s a bullish developement, but there’s work to be done (work to be done isn’t a bad thing – that’s the wall or worry the market tends to climb during an uptrend), but we are not “in the clear.” If the employment numbers Friday are good, the market could soar. If they aren’t good, it’ll be one more piece of bad news that needs to be absorbed. At least the bulls have a cushion to work with.

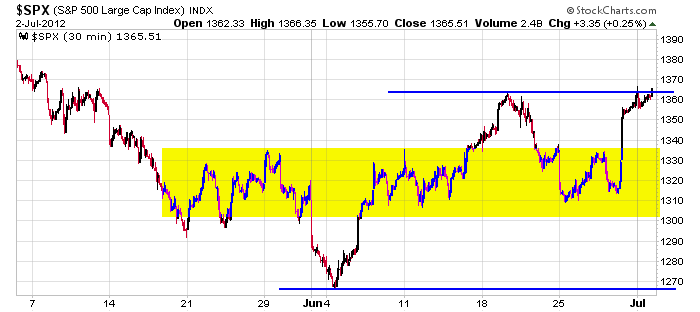

Here’s the 30-min S&P chart. The index traded range bound for six weeks (between 1300 and 1335) while marking a brief move down in early June and an equally brief move up in mid June. Now the index is making another rally attempt. Unfortunately with the mid week holiday, we may not find out if this move has legs until next week. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 3)”

Leave a Reply

You must be logged in to post a comment.

And the euro currency has given back 1/2 of its “Merkel blinked” Friday gains….

ism drops below 50 and commodities shoot straight up so now we can add inflation to our problems. that makes the worst possible scenario stagflation. time to pay the piper.

ws and republicans are going to fuk the world to get rid of bama. when you been fukd by ws you know you’ve fukd