Good morning. Happy Monday. Hope you had a nice weekend.

First off, Leavitt Brothers is now offering a FREE TRIAL. Go here to sign up.

So late in the day on Friday the SPX fell to 666 (our target per the daily chart was 665) and then rallied 20 points into the close. I view the move as nothing more than profit taking by the shorts into the weekend. I still believe the charts don’t matter too much. We’re not in unchartered territory, but we are at a level that hasn’t been seen since the mid 90’s.

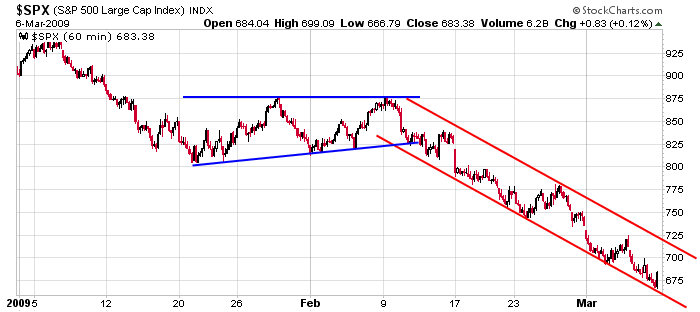

Every pop gets sold and new lows are made soon after, and as long as “too many” traders continue looking for a bottom, it’s not going to form. Here’s the SPX 60-min chart since the beginning of the year. I guess it’s possible we can grind out way to bottom. At some point in time there will be no one left to sell.

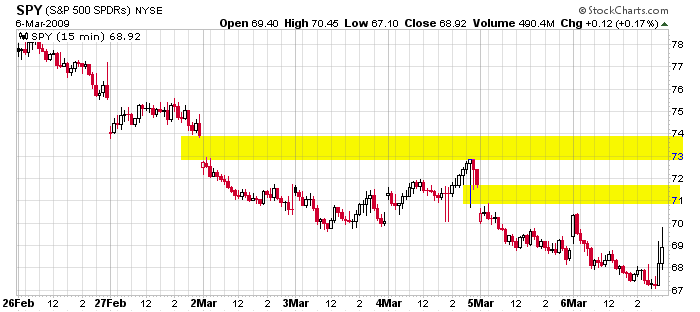

Here’s the SPY chart over the last 7 days. I use it because it shows the gaps better. For what it’s worth, a 10% move off the low only gets us to about 74. That’s how you know the market is in sick condition – when a 10% move only gets you back to a 5-day high.

I don’t have anything else to day right now. I don’t have feel for what will happen today. We got a 20-point rally into the close on Friday, and half that will be given back at today’s open. I could make a case new lows will be made today just as easily as I can fathom some chopping and churning before another move up begins. I’m in cash in will be day trading until I see more clarity.

headlines at Yahoo Finance

movers & shakers from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases