Good morning. Happy Friday.

First off, Leavitt Brothers is now offering a FREE TRIAL. Go here to sign up.

Now on to the market. The bears are relentless, aren’t they? Every little bounce gets sold hard. The market has now fallen 12 of the last 14 days, and barring a massive rally today, the 9th down week of the last 10 will be registered.

I’ve said a couple times this week the charts don’t matter too much right now. It’s all about emotions and supply & demand. I’m not going to draw a line from 10 or 15 years ago and say: “that’s it, that’s support.” People are watching their life savings get cut in half and some have no way of making the money back other than to wait 10 or 15 years and hope the market recovers. In this kind of environment, you never know when the breaking point will be. As bad as things have been, things could get a lot worse when Joe Sixpack throws in the towel.

And what about hedge funds? Easily 50% will go under. They all need to sell before they close up shop, and this of course will add more selling pressure to the mix. That’s why the market will drop further than it’s ‘supposed’ to…because there are several thousand large entities that have to unload everything.

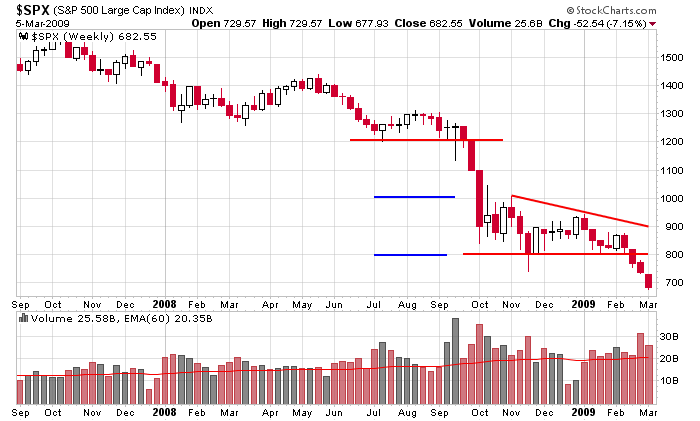

Here’s the weekly chart which puts our target at 600 (the size of the descending triangle (800-1000) suggests a 200-point sell-off).

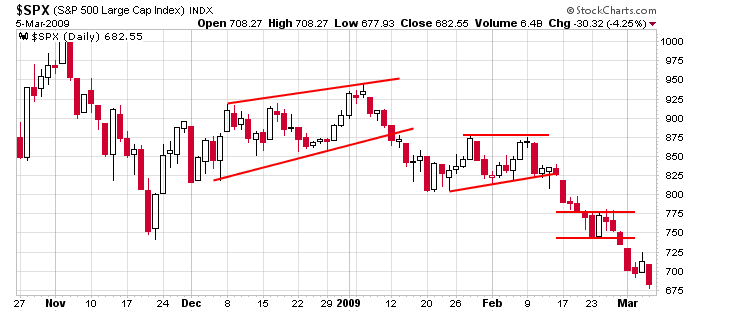

Here’s the daily chart. The move from 825 to the bottom of the flag pattern at 740 suggests an 85-point drop to 665.

Employment numbers are out. I think they’re in-line with expectations, but I’m not looking at them closely. I’m more concerned with the market’s reaction. At first the futures jumped up…now they’re coming back down. Who knows what they’ll be when the market opens in 55 minutes. I’m in cash now, I’ll be in cash at today’s close. This feels like a good weekend to circle the wagons, do a bunch of research and start from scratch next week.

headlines at Yahoo Finance

headlines from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases