Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. South Korea gained 2.1%; Hong Kong, Indonesia and Taiwan rallied beter than 1%. Europe is currently mixed. Belgium is up 4.6% and Austria is down 1%. France is flat. Germany is up; London is down. Futures here in the States point towards a positive open for the cash market.

The dollar is flat. Oil and copper are up. Gold and silver are up.

Yesterday was a dud. The market didn’t move up, and volume was very light. And things may not pick up until tomorrow. Still to go this week are interest rate announcements from the Fed, ECB and the Bank of London and the latest employment data. And of course lots more earnings reports.

There isn’t much influential news out from overseas. India left their interest rate unchanged at 8% and cut its growth outlook from 7.3% to 6.5%.

The unemployment rate in Germany has moved up four straight months.

China’s stock market is at a 3-year low.

Deutsche Bank’s profit dropped 63%. They’re laying off 1500 workers.

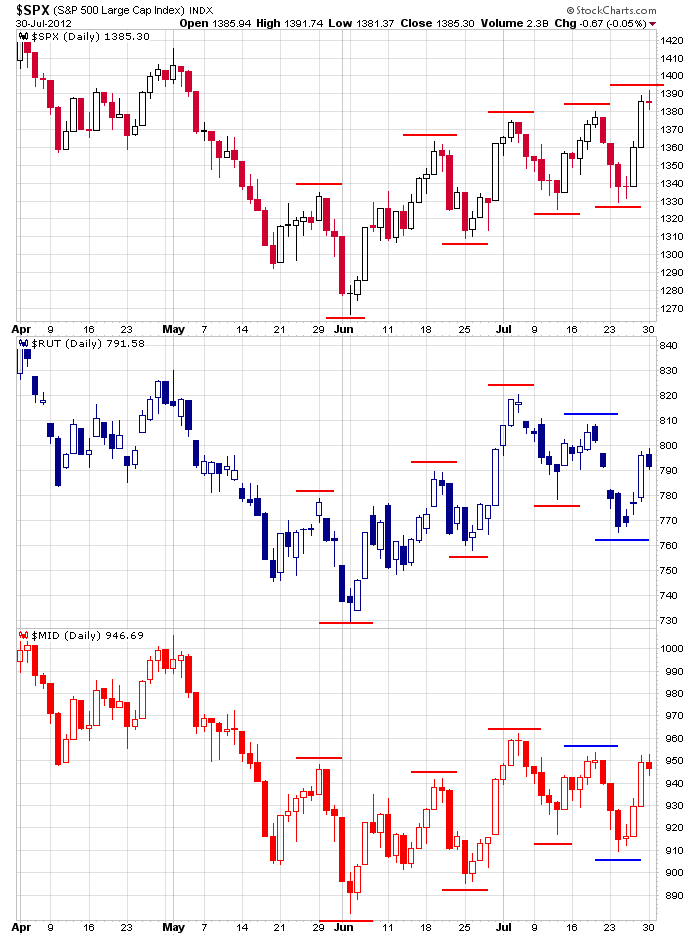

Thanks to two huge up days last Thursday and Friday, the bulls are breathing again. The move has given the bulls a cushion to work with (they have room for error, not every piece of news is live or die), but from a technical standpoint, one big divergence remains in place. That’s the progress of the large caps vs. the small and mid caps. When the market is healthy, when investors are confident, they buy more speculative stocks which have the potential to rally several hundred percent, not the rock-solid old-school companies which serve as safe-havens. So far, this isn’t happening. Recently, when the large caps made a higher high, the small and mid caps failed to match the move. This condition must be negated or there will be limited further upside. Here’s a chart of the S&P 500, Russell 2000 and S&P 400.

This is the lull before the storm. There are several big news items still to come this week.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 31)”

Leave a Reply

You must be logged in to post a comment.

Watch the EU, Spain tax collections were lower than expected, and the Germans have said they

do not support bonds to fund the debt payments of the southern members. The Draghi rally is being moderated quickly.

Case Shiller says down .7% overall on house prices. Not said is that the improvement has been possible because of the suspension of foreclosures on over two million homes. The legal foreclosure process will pick up speed later. Maybe Congress will wave its wand?

No matter what the Fed says it has been buying 77% of new treasury paper, the rollover of current Treasury debt in the next two years equals about 27% of the total public debt, 14.5 Trillion dollars. How does this work with 1.47% on TNX, .25 FF? It does not.

Things will implode in 2013, if the new tax and sequestrations don’t get us first. Yes, it is just the lull.

Thanks Whidbey – appreciate your thoughts

odds increase from 19 to 25% we’re going into another recession

and the market goes back up to flat during a fed meeting

what a surprise.

piece of shit fed is printing money and destroying the country

piece of shit government voted themselves a raise

only thing they’ve done in 4 years

congressmen are idiots, but they know how to steal

can anyone help my pet deadcats–gruesome and awesome

the fed cant its a deaf monkey

the ecb cant-its a dumb monkey

usa congress cant -its a blind monkey

and europe politicians are just stupid

wall street of course is just manic depressive,with wild swings under the control of the pschyitrists that want to control the world

as a minister of religion i will fix the world after we have somemore whipsaw and i have some daytrader fun

Thanks Whidbey for your sensible thoughts…a least one decent contribution !