Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China, Hong Kong, South Korea and Singapore moved down; New Zealand moved up, but nothing moved more than 1%. Europe is currenly mostly up. Switzerland and Greece are up about 1%. Futures here in the States point towards a positive open for the cash market.

The dollar is down. Oil is up, copper is down. Gold and silver are up.

The European Central Bank left its target rate unchanged at 0.75%.

The Bank of England held its benchmark rate unchanged at 0.50%.

The Fed did their thing yesterday, and now that Europe has made similar accouncements, focus shifts to tomorrow’s employment numbers.

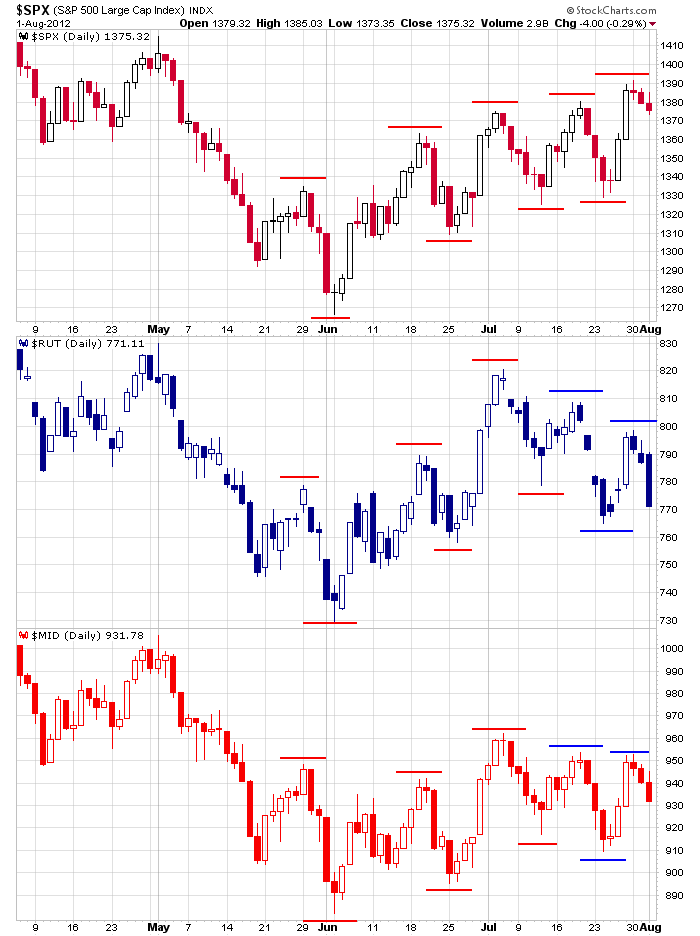

Many of the divergences I’ve discussed remain in place. On Monday the S&P made a higher high while the Russell small caps and S&P mid caps failed to match the movement. Yesterday most of the indexes dropped a small amount; the Russell dropped a bunch, thus making it much harder to negate the divergence. Here’s a chart comparing the three indexes.

Why do I keep talking about this? Well, mostly because it’s important, and I’m not one that needs a laundry list of reasons to form a bias. Having a list of 10 criteria and then saying: “7 of 10 are bearish, so therefore I’m bearish” is a terrible way to form an opinion. Often there is only one or two criteria that needs to be keyed on, and the rest are just noise or distractions.

Don’t make trading harder than it is. Most of a stock’s movement is based on the overall market and group it belongs to. Trade in the direction of the trend (there is no dominant trend right now); identify the best groups (groups run hot and cold as money rotates from one to the next); play the best stocks in those groups. And if it’s not obvious, take a pass. Better trades will set up. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 2)”

Leave a Reply

You must be logged in to post a comment.

Draghi was a drag. So yesterday in his monetary thinking. In a nut shell the ECB may do a lot if it has more cooperation and support for open market operations. The Germans are not in favor of more gifting to the profligate south. Political problem!

Jason should be negative what with the fiscal cliff on similar thinking here. Be cool and be short.

buying knight. KCG punishment overdone

TYVM Whidlbey – I concur and appreciate your viewpoint.

VALE–gruesome and awesome–my pet dead cats are DEAD

try KCG bought 2.88 sold 4.00 30% 1 hr

b 3.24 s 3.55 10% 15 min

2912 crumbling look out below

my pet bears–teddy and fearless are grouling with extossy

agree with fearless great volitility! I haven’t pulled out the margiritas in the morning for a long time. rock and roll baby

a spark of fear for shorts and KCG blows up like supernova

come on lets go.

up or down dont let these shorts cover at 2.99