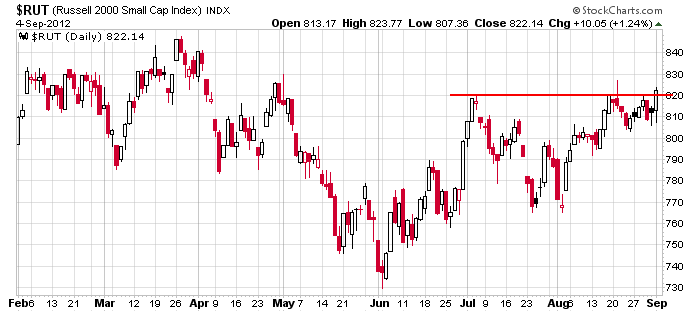

From a technical standpoint, today’s biggest story was the movement of the Russell 2000. During the day’s early weakness, it held up better than the other indexes, and then it rallied a bunch when everything turned around. It closed above resistance and now sits at its highest level since early May (on a closing basis). The small caps are no longer lagging. On a long term basis, the index is closer to an all-time high than any other index, and now on a short term basis, it’s the only index sitting at a higher high. This was a needed piece of the puzzle. We were not going to get a fall rally without the Russell participating.

0 thoughts on “The Russell 2000 Breaks Out”

Leave a Reply

You must be logged in to post a comment.

The russell leads, it does not lag.

thanks jason…………

Tanks,Jason for the heads up

i would still like to see more confirmation

as to me it looks like a lower double/triple top,

similar to some other indexes have already had

as a rule one index can stall out other indexes,so the rut making this pattern now could led to a crash or a move higher for all

Big Boyz rolling into small caps in anticipation of ECB buying up EuroCrap?