Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Hong Kong, South Korea, Japan and Taiwan rallied more than 1%. Europe is currently mostly up. Greece, the only big mover, is up almost 4%. Futures here in the States point to a moderate gap up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

The German constitution court has ruled Germany may participate in Europe’s bailout fund, but its contribution is capped at 190 billion EUR. If they want to contribute more, they need parliamentary approval.

Apple will show the world the iPhone 5 today at an event in San Francisco. I wonder when the law of diminishing returns sets in. In the 90’s, each new generation of desktop computer was much better and powerful than the one before, but at some point, this ceased being true. At some point you didn’t need to get a new computer just because a new one with a faster processor hit the market. When will that happen with smart phones (which are actually just handheld PCs)? The competition offers a very good alternatives at much better prices. When will people say those alternatives are “good enough?”

Italy sold 1-year notes at the lowest yield since last March.

Mark Zuckerberg spoke for the first time since Facebook’s IPO. He says their big mistake was betting on HTML 5 for their mobile app. I disagree. Facebook’s problem is the service is boring. It was fun at first to reconnect with old friends, but now the service is boring. I don’t need to listen to people’s political rants…or see a picture of their kids on the way to first grade…or see a picture what they had for dinner last night. My feelings are not isolated. Many people are just flat out bored with the site and are spending much less time there.

TXN upped their profit and revenue range.

PCAR warned a 15-20% sequential drop in truck production would result from a slow down in industry orders.

STLD said Q3 profit would come up well short of Wall St’s expectations.

JAH’s board approved additional repurchases of common stock, up to $250M more.

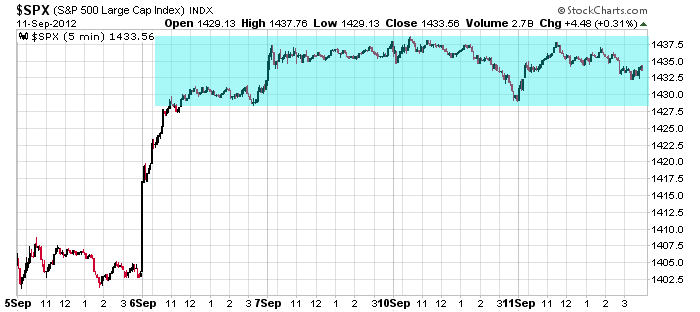

Here’s the S&P over the last five days. We’ve gotten almost four entire days of very slow, range-bound movement. Hopefully today’s German court ruling and tomorrow’s FOMC can wake this thing up.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 12)”

Leave a Reply

You must be logged in to post a comment.

They should change the name of “Facebook” to “fu**ed book”

Your feelings are isolated about FB or are NOT isolated.

Karen

Thanks, fixed it.

Yes Jason, I agree,and the ‘privacy’ issues didn’t help either….the Novelty is definately wearing off !

Thought the ‘Dow’ would have risen more due to Germs court ruling…..