Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. China and Indonesia led the way with 0.9% and 0.7% drops. Europe is currently down across the board. Austria and Belgium are down more than 1%. Futures here in the States point towards a down open for the cash market.

The dollar is up slightly. Oil and copper are down. Gold and silver are down.

FedEX (FDX) is out with earnings. They again said the global economy is worsening, and it’s cutting its forecast for the current fiscal year. The stock is down almost 2% in premarket trading.

ANR is cutting 1200 out of 13,100 jobs.

KSS says it will boost hiring this holiday season.

Since nothing happened yesterday, there isn’t much to talk about. The trend is up, but most good stocks have already broken out and rallied. There aren’t many left to play, and the risk/rewards aren’t very good either. The big issue with initiating new longs right now it timing. When you play breakouts at the beginning of an uptrend, making money is relatively easy because at the beginning of a move, a rising tide raises most ships. But those same set ups played at a later date after an extended move won’t have the same “group support.” This is the current situation. We don’t have many new set ups to play, and given the extent of the rally and all good news out lately (lack of an upside catalyst), it’s best to play good defense now.

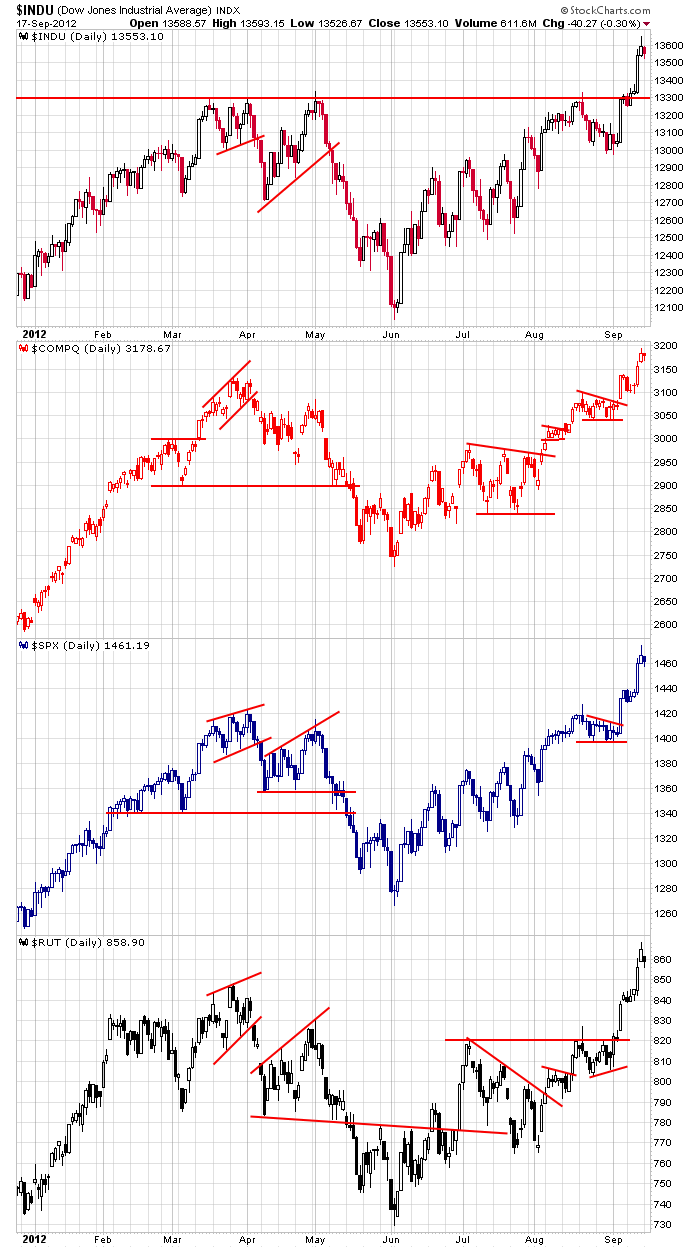

Here are the dailies. They look great, but in the near term I’m on the lookout for a blow-off top.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 18)”

Leave a Reply

You must be logged in to post a comment.

The PAR model out of Boston (parmodel.com) today says 11% up in equities over the next 6 months. Maybe, the model has a good history, but not a long history. A factor model with a

black box at the heart. Hard to get excited.

As it is we are invested in bonds, stocks and PMs. Our models are saying be in the market just due to the ECB/Fed/BOC all applying QE. In general all the liquidity should float the markets up at the risk of some inflation. But right now they fear recessionary disinflation and maybe deflation, so QE. When in doubt a little SP5, and lots of cash.

Thanks WHIB – Where’s Auzzie ?? any thoughts from down under?

my Aussie teacher taught me to ask each day–“””what are the buyers/sellers doing /thinking””

thats why i like Jasons comments each day and today i think Jason is saying daytrade only,or take profits or stay out of new traders

i agree –daytrading is exhilerating and many clear indexes up and down intraday moved

we need to consider the quad witches and the insto bank market makers take the opposing side to the bully retailers/mutuals

as for liquidity–it was a smokescrean con –ecb has put in NO new sterilized money and the feds contribution is pathetic

i am the great cheif of the bears–cheif crazy bear and my staff -teddy bear and awesome bear

tell me that there are no set ups yet and the bulls are tired and lazy and to fat and need a good stampead to loose wait

but because of my status and bias mind set –i cannot trade long term

and basicly im only good for daytrading–that i can do professionaly with out a bias and enjoy

Thanks Mate!