Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly down, but there were only a couple noticable movers. Indonesia dropped 1%, and Malaysia dropped 0.7%. Europe is currently down across the board. Austria and France are down 1%; Belgium is not far behind. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

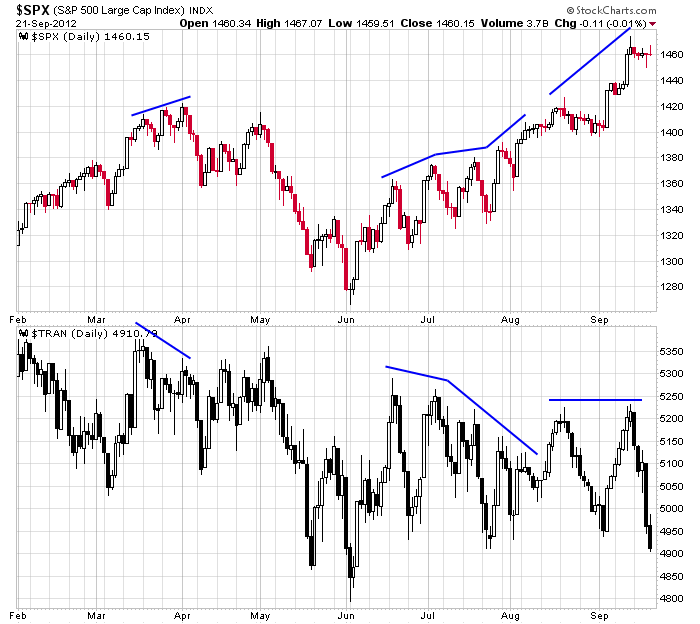

I don’t have anything to add to the comments I made over the weekend in the Index Report. The trend is up, and from a technical standpoint the market is in good shape. A few warnings popped up last week – a few warnings here an there are nothing to be concered about – but I don’t like the movement of the transports and semis. And there are a few indicators which reached overbought levels and need more time to cycle down. I favor the upside, but given the lack of good set ups and the large number of traders we’ve had recently that have broken out nicely and rallied to their targets, it’s best to be defensive here.

Here’s the S&P vs. Transports chart. Yuk!

LEN beat earnings expectations. Their CEO said the housing market has stablized and a recovery is well underway.

The Foxconn factory in China (that’s where iPhones are made) was shut down after 2000 workers started brawling.

FB is down more than 4% before the open. Barron’s ran a story saying the stock was worth $15.

QCOR is down 20% before the open…this is on top of getting killed last week.

Overall the technicals are in pretty good shape, but the news flow leans to the downside. I would not be “all in” right now. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers