Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. China rallied 2.6%; Hong Kong and Indonesia moved up more than 1%. Europe is currently mostly up. Belgium is down 1.6%; Austria is up 1.9%, and the Czech Republic is up 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down slightly. Oil and copper are up. Gold and silver are up.

The big news out today is the unveiling of Spain’s 2013. There needs to be enough cuts to appease troika lenders buy most of the country is against austerity, and the Catalonia region is moving towards wanting to break off as its own country because it’s tired of carrying an outsized financial burdon. Does the budget strike a happy balance?

Spanish bank deposits fell to their lowest level in more than four years.

Italy sold bonds today without any issues…5-year notes yields fell to their lowest level since May 2011.

The People’s Bank of China injected record amounts of liquidity into the financial system this week.

US jobless claims fell 25K to 359K. That’s the lowest level since late July, but the 4-week MA is more important than a single data point. It dropped 4K to 374K.

Tempur-Pedic is buying rival Sealy.

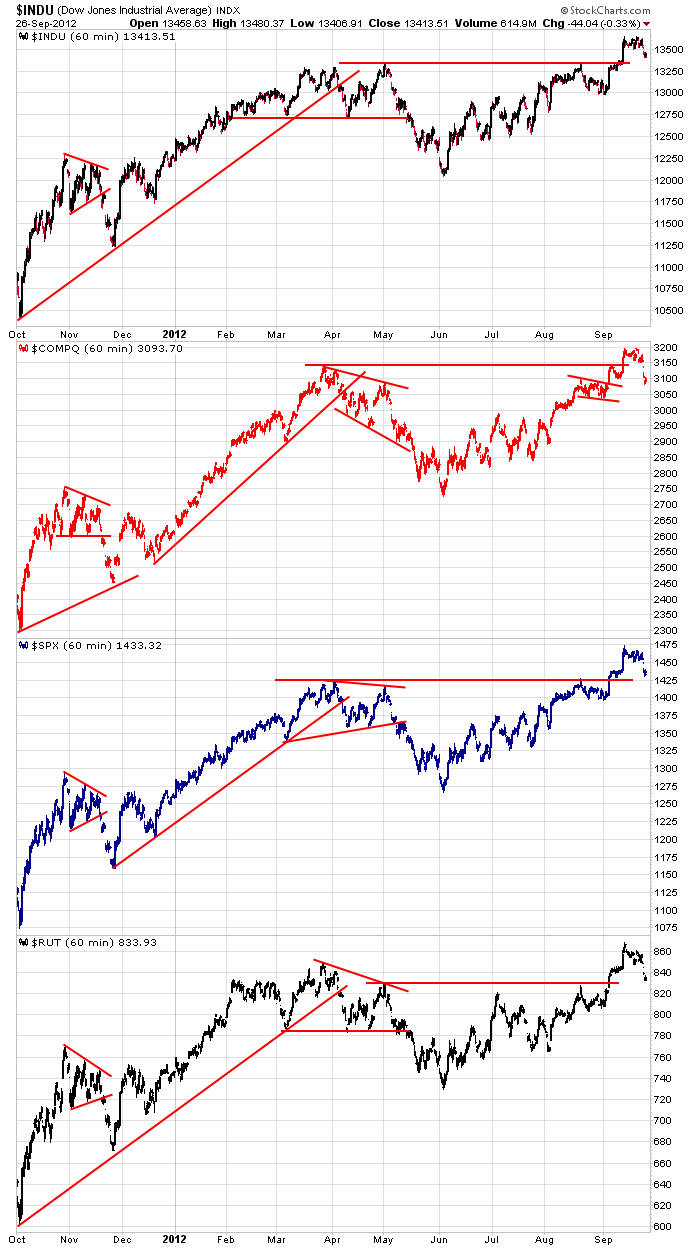

Here are the 60-min index charts going back one year. Each traded at a new high within the last two weeks, and despite the recent selling pressure, each is still making higher highs and higher lows. The Nas got the least amount of follow through when it took out horizontal resistance, and it has now given up that level on the way down. Let’s see if the others can hold up. Overall these charts aren’t in bad shape, but we don’t have many good set ups to play with right now. Patience is needed. There’s a time to be aggressive and a time to be conservative. Right now I’m being conservative. Play good defense. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 27)”

Leave a Reply

You must be logged in to post a comment.

GDP down a little and first times cliams down a little. In the meanwhile the joy over China falls leading to added stimulus is a symptom of what is killing world markets. Politican-economists control the markets. Nothing but evil can follow.

corp bonds or cash is still the place for prudent investors.

whidbey, that’s been my thinking since June, and look where it’s gotten me: missed out on a huge run-up, waiting along with the herd for the market to “correct”. Is this the turn we’ve been waiting for? Jeez, I hope so.