Good morning. Happy Tuesday.

I said yesterday the charts didn’t matter much because the market was on an edge. It was either going to break down and result in a horrible collapse or rally. There was no middle of the road. Draw all the lines you want on all your charts; they don’t matter as much when emotions are running high. Now it’s a new day, and after all the indexes suffered steep losses yesterday and closed at their lows, I still don’t think the charts matter much.

7 of the last 8 weeks have been down weeks.

10 of the last 11 days have been down days.

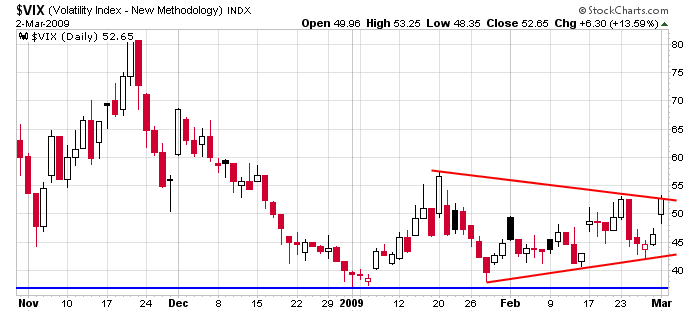

Yesterday we got pretty close to a 90/10 day. That’s where 90% of stocks drop and 90% of volume is declining volume. We also got a nice move up in the VIX (shown below). A cluster – or at least two – 90/10 days would likely result in a bounce lasting several weeks or longer whereas an isolated occurrence wouldn’t have as bullish implications.

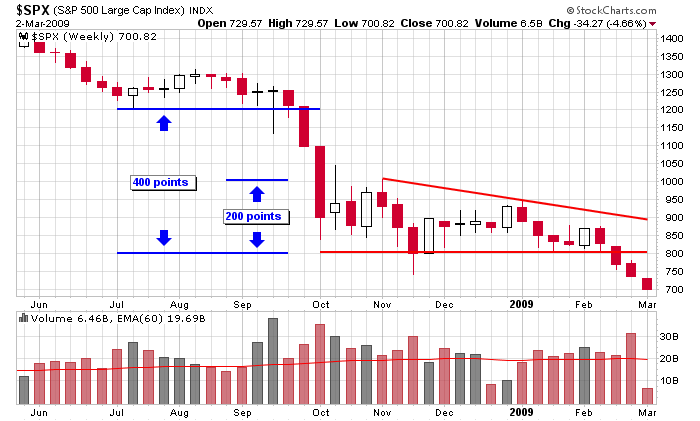

Many months ago I loosely pinned my SPX target at 600. Some people thought I was nuts, but now that we’re only 100 points away, it doesn’t seem so far fetched. In fact some people have no leap-froged me and said the market is falling to 500. Based on the weekly chart charts shown below, depending on whether the size of the descending pattern is used or the move into the pattern, the target is either 600 or 400. I an case, I don’t make money predicting the market; I make money trading it, so my projects are there only to give me a frame of reference to work from.

headlines at Yahoo Finance

movers & shakers from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases