Good morning. Happy Monday. Hope you had a nice weekend.

The indexes closed near their lows on Friday. The SPX and Dow took out their 2002 lows; the Nas and Russell did not.

I’m not sure the charts mean much right now. The market is sitting on an edge. It’s either going to collapse or rally big very soon.

I’m not a big fan of picking a number from 10 years ago and saying “that’s the next support level,” so I really don’t know where the bottom will be (short term or ultimate). My SPX target has been 600 for quite some time – it’s just a question of whether it happens now or later. My preference is to get a washout now and then a nice bounce to short, but I don’t always get what I want.

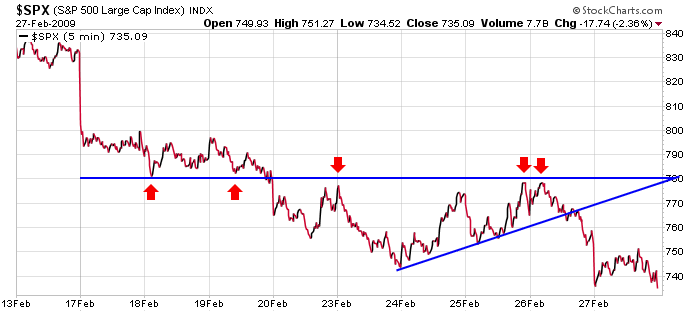

As far as upside potential, SPX 780 has been tough to overcome…then 825…then 875. The chart below indicates how I get 780.

The foreign markets have gotten/are getting clobbered today. Futures here in the States indicate a sizeable gap down open. We need a very nasty day to signal a bottom…one where the VIX spikes up and most stocks decline. Perhaps today will be the day, but I do know this. There seems to be many traders out there looking for a bottom, and as long as that’s the case, it’s not going to happen. The market will go down one or two extra days to make those traders nonbelievers before bouncing.

In many cases it’s too late to go short, and of course I’m not going long quite yet. Let’s manage the positions we have, and when the washout comes, be ready to go long.

headlines at Yahoo Finance

movers & shakers from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases