Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed mixed. There were no standout winners or losers. Europe is currently trading mixed and with a bullish bias. Greece is up 3.7%; otherwise there are no big movers. Futures here in the States point towards a positive open for the cash market.

The dollar is down. Oil is up, copper down. Gold and silver are up.

I don’t have anything to add to the comments made in the weekly report posted yesterday, so let’s get to the key news and earnings reports out this morning.

Caterpillar (CAT) beat on earnings but missed on revenue. It then cut 2012 earnings and sales forecast and is down about 1% in premarket trading.

Pfizer (PFE) is buying privately held NextWave Pharmaceuticals.

Ancestry.com (ACOM) is being acquired by a private equity firm in Europe.

PHG report higher profit and revenue and is up 6% before the open.

Peabody (BTU) is up 5% after releasing earnings.

Avid Tech (AVID) forecast a surprise Q3 loss…stock is down 14%.

Microsoft (MSFT) is releasing Windows 8 this week.

Freeport-McMoRan (FCX) is flat after releasing earnings.

VF Corp (VFC) profit rose and they raised their dividend, but the stock is down 4.5%.

Tonight is the final presidential debate. The first two were very important, so this one too could sway voters one way or the other.

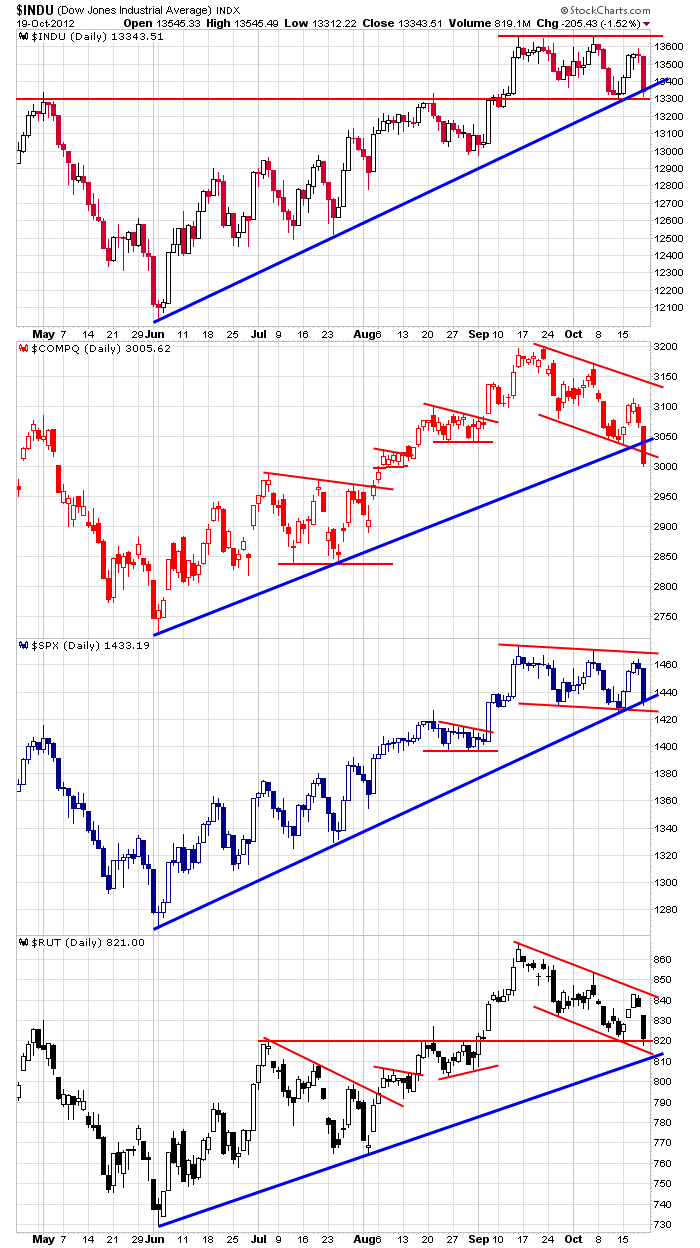

Here’s an update of the daily index charts. Over the last 5-6 weeks, the Dow and S&P have formed consolidation patterns within uptrends while the Nas and Russell have clearly made lower highs and lower lows. Over the last 5 months, all but the Nas could still be considered in uptrends. Warnings started surfacing several weeks ago, so if you’ve listened to the rumblings of the market, you would have stayed out of trouble the last few weeks. It’s important to be objective, to read the charts as they are and not offer excuses or explanations as to why they may be wrong. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 22)”

Leave a Reply

You must be logged in to post a comment.

Think wer’re on a 5 wave within a 5 wave ….good time to short the SPY……

I see one more leg up after some sideways motion – This week will be flat – And i have my fingers crossed 😀