Good morning. Happy Monday. Hope you had a great weekend.

I’m going to change what I do for the premarket comments. For the past few months I’ve somehow gotten a little off course by becoming very news headline oriented. I would spend a lot of time typing up headlines knowing they weren’t nearly as important as the charts. So from now on, I’m going to talk much more about support, resistance and likely scenarios. You can get headlines from numerous sites such as Yahoo Finance and MarketWatch.

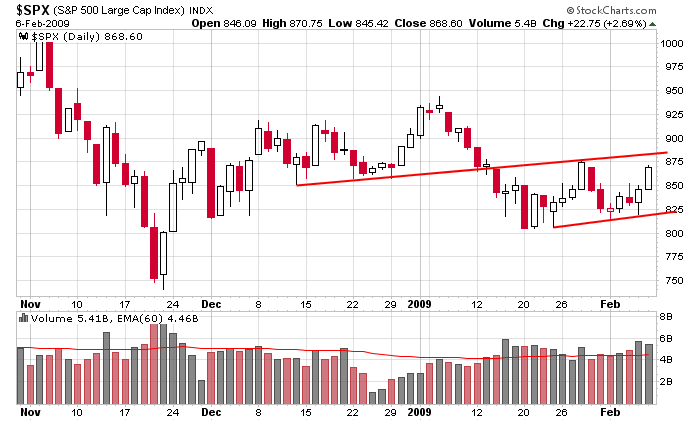

The overall trend is down, but we’re coming off two decent up days last Thursday and Friday. The market is ripe for a gap-up-and-sell-off, but the gap up requirement isn’t going to happen. Instead we’ll get a moderate gap down. On an intraday basis, if the indexes can fill its opening gap down, holding last Friday’s close will be key. If price gets rejected there, we could be in for a nasty down day, but if price can hold that level, the mini uptrend we’re in is likely to test resistance shown below in the daily SPX chart. Then, the market will again have an opportunity to show its true stripes.

The VIX and put/call are at low levels, so trades to the upside continue to be short term only.

headlines at Yahoo Finance

movers & shakers from MarketWatch

upgrades/downgrades