Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Australia dropped 1.2%, South Korea 0.7%. China rallied 1.7%, Hong Kong 0.8%. Europe is currently mostly up. Greece is down 4.1%, but Austria, France, Germany and London are posting decent gains. Futures here in the Stats suggest a flat open for the cash market.

The dollar is up slightly. Oil and copper are up a small amount. Gold and silver are up.

Even though there was potentially a lot of pent up supply and demand heading into yesterday, the day turned out to be a pretty average day…a few swings but calm and orderly movement. October 2012 ended with across-the-board losses and closes near the bottom of the intramonth ranges.

A new month now begins. Earnings season remains in full force…we get the latest employment data tomorrow…the election is quickly approaching. Here are earnings reports and same-store sales numbers released today.

Pfizer (PFE) posted a profit decline…the stock is down 1.4%.

The Buckle (BKE) posted very good same store sales…the stock is up 2%.

RR Donnelley’s (RRD) Q3 profit declined, they cut their 2012 revenue forecast…the stock is down 1.1%.

Cigna (CI) easily topped Wall St. expectations and raised its outlook for the full year…stock has not traded premarket yet.

Avon’s (AVP) net income fell 81%, the company cut its dividend…stock is down almost 3%.

Sony (SNE) reported a much smaller loss compared to the same quarter a year ago…the stock is flat.

Kellogg (K) is out with earnings…the stock is flat.

Gap (GPS) missed same-store sales expectations.

Exxon Mobil (XOM) reported a 7% profit decline, which beat expectations…the stock is down 0.7%.

Macy’s (M) beat same-store sales expectations.

Target’s (TGT) same-store sales came in at the low end of their targeted range…stock is down 1.7%.

Estee Lauder (EL) reported better-than-expected earnings.

Teva Pharm (TEVA) has swung to a loss.

Suncor Energy’s (SU) profit climbed 21%, beating expectations…the stock is up 2.3%.

Limited (LTD) did well with same-store sales but total sales dropped…the stock is down 1.9%.

Spectra Energy (SE) Q3 profit dropped 30%.

Costco (COST) did well with same-store sales…stock is up slightly.

Also moving before the open…JDAS up 17.5%, NEWP up 11%, ABMD down 14%, ZUMZ up 16%.

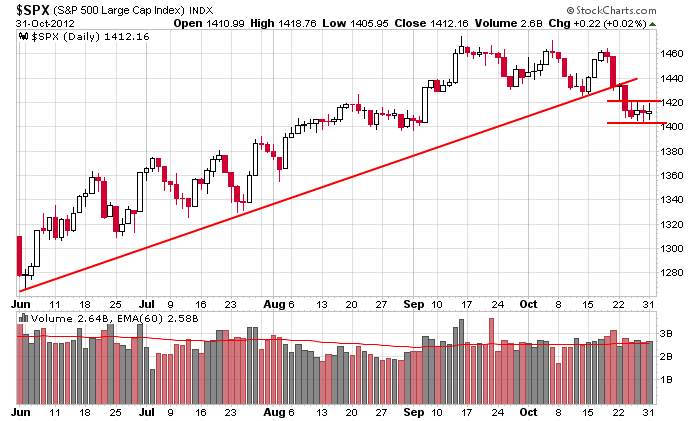

Here is an updated version of the daily S&P. The uptrend off the June bottom was broken two weeks ago; now a little flag pattern is forming. The trendline break won’t automatically result in the market trending down (the uptrend can continue at a shallower slope), but it does make us pause. The market now needs to show its cards. The flag pattern can resolve down and officially begin a downtrend. We could get a false move down followed by a snap back rally. Or the index can move to the upside and trade range bound between 1400 and 1460. Some mental flexibility is required here. Don’t be too opinionated. If the market can hold on for a few more weeks, we’ll enter the feel-good holiday season. You never know. Sentiment has dropped lately, but if it can hold on, time will improve things. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 1)”

Leave a Reply

You must be logged in to post a comment.

Small caps have been out performing the NASDAQ. Signs of a reversal.

Paul