Good morning. Happy Tuesday. Happy Election Day.

The Asian/Pacific markets closed mixed. South Korea gained 1% and Taiwan 0.7%. Malaysia dropped 0.5% and Singapore 0.4%. Europe is currently up across the board. Greece is up 1.1%, the Czech Republic 0.9%, Amsterdam 0.7% and Stockholm 0.6%. Futures here in the States point towards a modest gap up open for the cash market.

The dollar is down slightly. Oil and copper are up. Gold and silver are up.

So today is election day, and according to polls (I never trust them), the race between Obama and Romney is basically even. And while this adds intrigue to the day, it has led both parties to have lawyers lined up in all the swing states ready to contest any close race. My hope is today goes smoothly and one candidate wins easily, so when we head off to bed tonight, we know who will be president the next four years. A close race, while understandable because the country is very divided, is not disireable.

Here are earnings related stories…

DirectTV (DTV) reported a 9.5% jump in earnings, but their subscriber churn rate increased. The stock is down 1% before the open.

AOL (AOL) posted a bigger-than-expected Q3 profit. The stock is up 1%.

CVS Caremark (CVS) posted a good report and revised their 2012 outlook up. The stock is up 2%.

Fossil (FOSL) is down almost 10% after steering Wall St. lower regarding its top-line revenue number.

Office Depot (ODP) posted a net loss for Q3 because quarterly sales dropped, but its bottom-line number was better-than-expected.

Discovery Communications’ (DISCA) Q3 earnings dropped 14%.

Emerson Electric (EMR) reported Q4 earnings dropped 63%. The stock is up 2.1%.

Towers Watson’s (TW) Q1 earnings dropped even though earnings rose a little.

Calpine’s (CPN) Q3 profit more than doubled, and they’re selling Broad River Energy Center for $427M.

Marsh & McLennan’s (MMC) Q3 profit jumped 85%…mostly due to last year being down a bunch.

Marathon Oil (MRO) is out with earnings.

EOG Resources (EOG) is up 5.5%

Zillow (Z) did not do well with earnings. The stock is down nearly 20%.

Raptor Pharma (RPTP) is up 16%.

SuperMedia (SPMD) is up 15%.

ServiceSource (SREV) is down 27%.

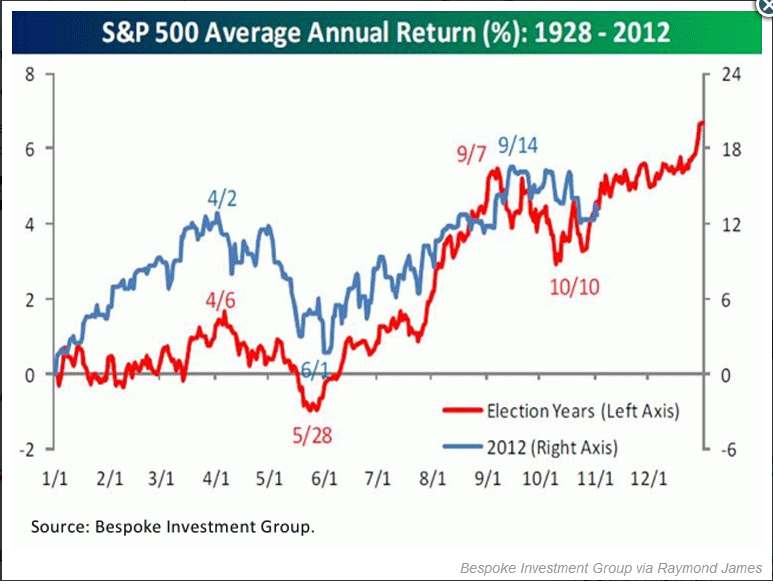

Here’s the chart I posted yesterday. The red line is the S&P’s movement during election years going back to 1928. The blue line is the current year’s progress. In my opinion the upward bias is directly related to hope and optimism that whoever is in office the following four years (same guy or different guy), it’s a good thing. I keep these charts in the back of my mind, but I don’t trade a certain way because of them. Whenever you take the average of many data points, you end up with something in the middle, and in any given year, the results can swing widely one way or the other. Unless you’re going to take a trade every four years for the next 100 years, I also would not rely on such a chart too much.

Here’s to hoping today is not a repeat of 2000. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers