Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Hong Kong, India and Japan dropped 0.9%, Taiwan rallied 0.7%. Europe is currently mostly down. France, Germany, Stockholm and the Czech Republic are down more than 1%. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

The Bank of Australia trimmed the growth forecast for the country.

Here are earnings related items…

Groupon (GRPN) is down almost 20%…Disney (DIS) is down 4.2%…J.C. Penney (JCP) is down almost 5%…all earnings related

Apollo Global Management (APO) moved from a big loss to a profit.

Warner Chilcott (WCRX) reported higher net profits but lower revenue. They revised its full-year guidance up. The stock is up almost 7%.

Zipcar’s (ZIP) profit surged…stock is up 27%.

Kayak (KYAK) is up 26%.

Hallwood Group is up 27%.

Foster Wheeler (FWLT) reported Q3 profit jumped 58%.

Stryer Education (STRA) posted a 71% drop in earnings…stock is down 8.3%.

Flowers Foods (FLO) and Alliant Energy (LNT) are also out with earnings.

NVIDIA (NVDA) did well with earning…they announced a dividend.

Spreadtrum (SPRD) is down 12.5% after reporting a 41% drop in Q3 net income.

Dolby (DLB) reported lower net income amid higher costs and lower revenue.

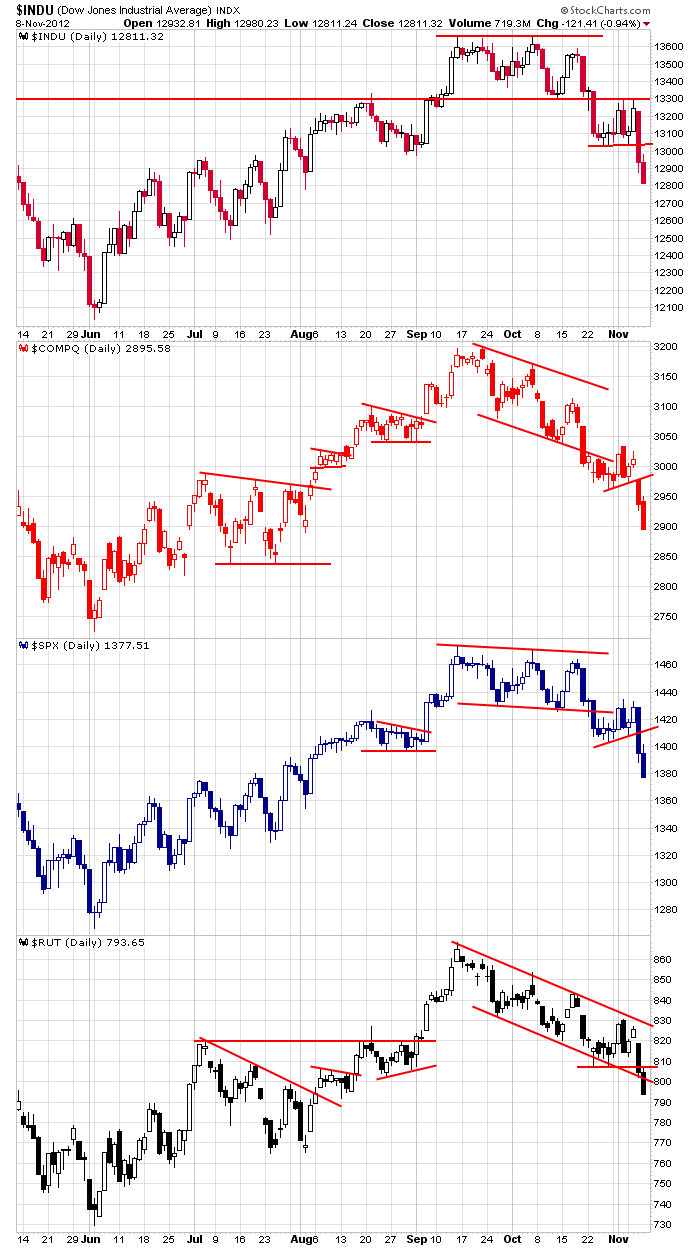

The market is practically in a free fall right now. It sliced through support on Wednesday, followed through on Thursday and is now set to gap down today. Here are the daily charts.

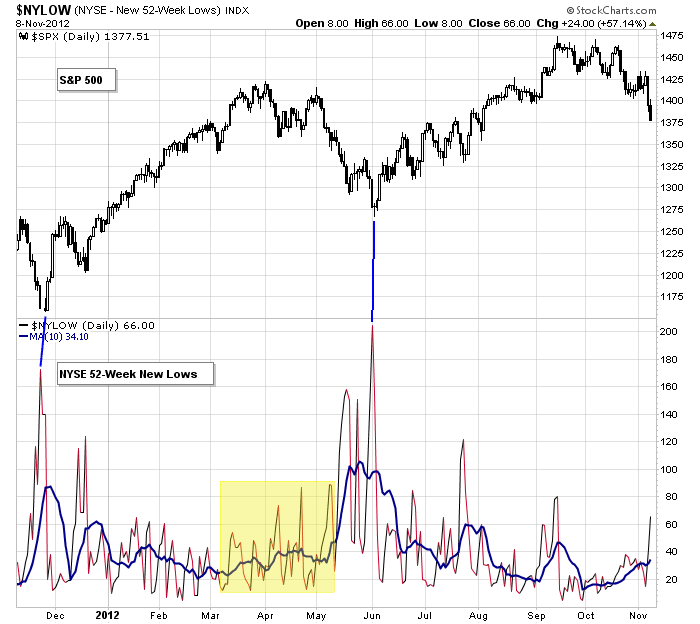

Don’t try to catch a falling knife. I’m waiting for indicators such as the NYSE new 52-week lows to spike.

More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 9)”

Leave a Reply

You must be logged in to post a comment.

some good insight jason……thanks !!!