Good morning. Happy Wednesday.

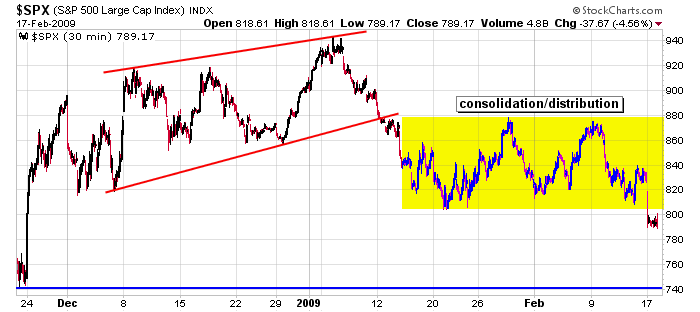

It was stated yesterday the market was starting the new week on an edge, and it looks like the edge has given way. All the indexes broke support; several are at their lowest level since the Nov lows. It appears as if 5 weeks on consolidation has resolved down. We’ve been buying dips and selling rallies and being ahead of the curve taking profits, but we are no longer interested in buying dips. Here’s the 30-min SPX chart from yesterday.

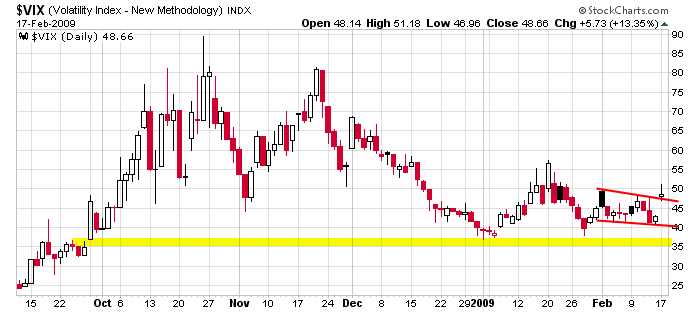

Longer term I still think the market goes much lower, but who knows what happens at the Nov low. Perhaps it holds; perhaps it doesn’t. I hope it holds and we get a nice bounce to short again. The worst case scenario would be the SPX dropping to 500-600 and then flat-lining for couple years. Hopefully we get some nice bounces to play along the way. Here’s the VIX chart. It broke out yesterday and has much more room to move before signaling extreme fear.

No more buying dips. Instead we’ll just keep shorting the rallies.

headlines at Yahoo Finance

movers & shakers from MarketWatch

upgrades/downgrades

earnings & economic releases