Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. Japan, Indonesia, China, Hong Kong and South Korea led the way on the down side. Europe is currently mostly down. Norway, Greece and the Czech Republic are down more than 1%; Stockholm, France and Austria are down noticeably too. Futures here in the States point towards a gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

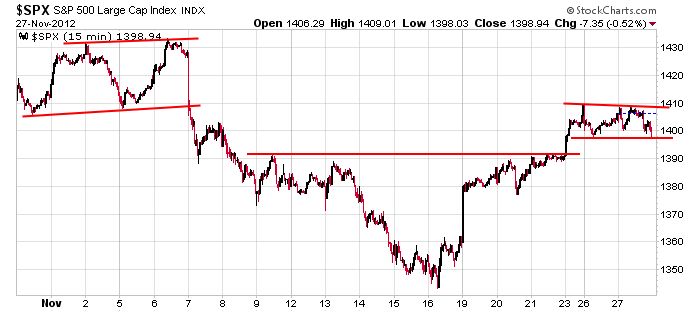

After putting in its biggest up weak in several months, the market has rested the last two days. No big deal. It’s healthy and normal for the market to alternate between trending and resting. But in my opinion, the market has merely moved off its low. The intermediate term trend is still down, so the market has some proving to do. The first move is the easy move; now things get tougher. Here’s an update of the 15-min chart.

Costco (COST) announced a one-time special dividend of $7 per share.

Green Mounain (GMCR) did great with earnings…the stock is up 22% in premarket trading. I wonder if David Einhorn is still short.

American Eagle (AEO) is up 6.2%…earnings related.

Smith & Nephew (SNN) is acquiring Healthpoint Bio.

Movado (MOV) is up 5.5%…earnings related.

W&T Offshore (WTI) has cut their full-year production estimates.

Express (EXPR) reported earnings at the high end of their range…stock is up 13%.

The CEO’s of numerous companies will be meeting with Obama today to discuss the United States fiscal problems.

I’ve been saying for a couple days the risk/rewards are not nearly as good now as they were a week ago, so we’ve needed to be careful initiating new longs. This attitude has served us well. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers