Good morning. Happy Thursday.

Leavitt Brothers special offer…click here

The Asian/Pacific markets closed mostly up. Hong Kong, India, Japan, Singapore, South Korea and Taiwan all did very well. Europe is currently up across-the-board. Austria, France, Germany, Amsterdam, Norway, Stockholm, Switzerland, London, Greece and the Czech Republic are posting solid gains. Futures here in the States point towards a big gap up for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

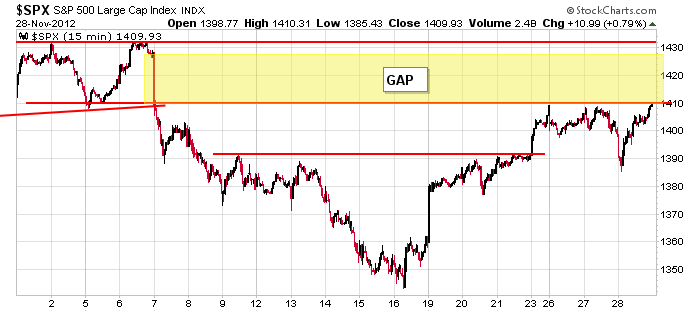

Here’s an update of the S&P 15-min chart I’ve been posting. Yesterday the index fell out of its tight range, but it recovered quickly and now sits just under 1410, which has served as both support and resistance this month. As of now the S&P is going to gap up about 8 points, so part of the gap will be filled with a gap. Does that count?

Retailers are out with same-store sales. Some did well, others blamed hurricane Sandy on soft sales.

Research in Motion (RIMM) continues to climb. Goldman upgraded it.

Infoblox (BLOX) is up 27%…earnings related.

Gold Field (GFI) is up 5.3%…they’re spinning off two strike-hit mines into separate companies.

ASML (ASML) is down almost 19% in thin premarket trading.

Tiffany (TIF) dropped almost 8% after cutting 2012 profit forecast.

Aeropostal (ARO) is down almost 8%…earnings related.

Cisco (CSCO) is buying privately-held Cariden Tech.

Belden (BDC) is buying back $200M in stock.

Abbott (ABT) is spinning off its pharmaceutical business.

The first move is the easy move, but yesterday’s move is part of the second move. It provides evidence bigger players who play longer time frames are entering the market. My bias continues to be to the upside. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 29)”

Leave a Reply

You must be logged in to post a comment.

I am betting this gap will fill before monday close.