Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. China, India, New Zealand, Singapore and Taiwan posted solid gains; Indonesia dropped. Europe is currently mostly up. The Czech Republic is posting the biggest gain; Austria, Germany and Stockholm are doing well too. Futures here in the States point towards a flat open for the cash market.

The dollar is flat. Oil is down, copper is up. Gold is up slightly, silver down a small amount.

It’s the last day of November, and the S&P is up almost 4 points on the month. What were the odds I could make this statement two weeks ago when the index was down 70? Several indicators told us a bottom was in. Mental flexibility is needed in this business. It’s best not to fight the charts.

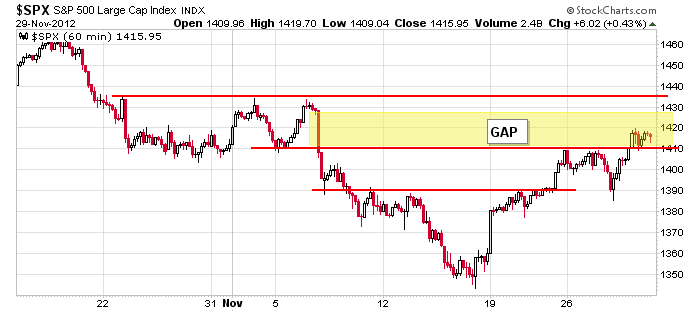

Here’s the 60-minute S&P chart. The index has moved from one significant level to the next. Right now it seems to be consolidating its recent move above 1410 and is sitting in the middle of the early-November gap down. It shouldn’t be too hard to press to the top of the range near 1435. After that things will get a little tougher.

Teva Pharmaceuticals (TEVA) lowered its 2013 full-year earnings guidance.

Siemens is cutting an additional 4,700 jobs in its lighting subsidiary (they’ve already cut 1,900).

Tellabs (TLAB) is paying a special $1 dividend…the stock is up 17% in premarket trading.

Disney (DIS) is increasing its dividend 25%.

St. Jude Medical (STJ) is buying back $1B in common stock.

Seagate (STX) increased its dividend 19%.

United Natural Foods (UNFI) posted solid earnings…Genesco (GCO) raised its full-year earnings forecast…YUM Brands (YUM) released a disappointing 2013 forecast and expects softer China sales.

My bias remains to the upside…as it’s been the last two weeks. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers