Good morning. Happy Thursday.

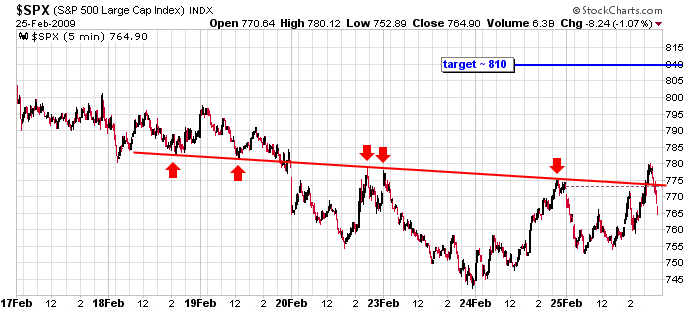

Totally random movement yesterday. Every little bit of news out of Washington caused either a moderate rally or sell-off. Here’s the SPX 5-min chart over the last 7 days. The index had broken out from a head-n-shoulder bottom, but the end-of-day sell-off destroyed the pattern. We do however have a higher high and higher low in place.

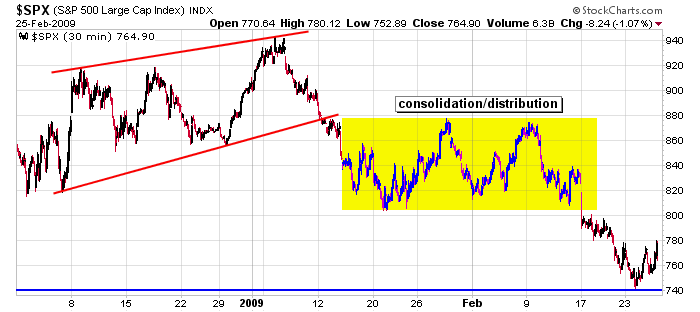

Backing up, here’s the 30-min SPX chart. The head-n-shoulders above projects a move to about 810 – right near the bottom of the consolidation zone we identified last week. I still think that’s very doable – assuming we don’t get horrible news out of Washington.

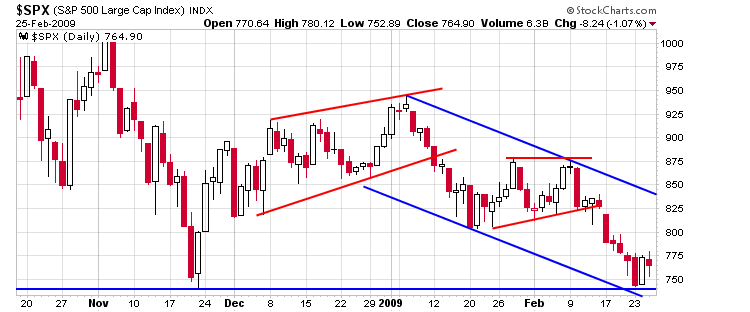

Backing up further, here’s the daily. The long term trend is obviously down; this chart tells us how far the SPX can move up but still be considered in an intermediate term down trend.

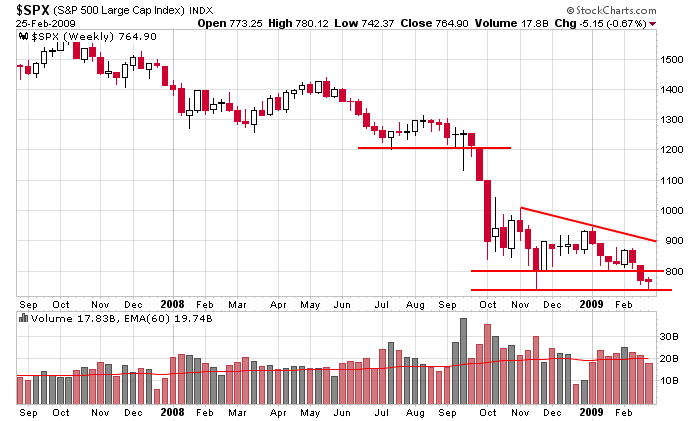

One more: the weekly. If 800 is the bottom of the descending triangle, the long term target is 600, but if we get a nice bounce here and 750 is the bottom of a larger triangle, the target is 500.

Be a little conservative here. News from Washington can jerk the market in either direction. My sense is the market wants to move up, but since we never got a total washout, I’d expect a rally to get sold sooner rather than later.

headlines at Yahoo Finance

movers & shakers from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases