Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed and with an upward slant. Japan, Malaysia and South Korea moved up. Europe is currently up across-the-board (except for Greece). Austria and the Czech Republic are leading the way; Belgium, Germany and London are doing well too. Futures here in the States point towards a gap up open for the cash market.

The dollar is down a small amount. Oil is up, copper down. Gold is flat, silver is up.

Yesterday’s solid move up was largely due to news from Washington the two sides of the fiscal cliff talks were getting closer by conceding a few things. Today we’re getting more of the same type of news. Supposedly Obama is willing to raise his upper threshold from $250K to $400K and he’s agreed to cut spending $1.2T.

Facebook (FB) is in the news again with its new Terms or Service. Apparently they’re granting themselves permission to sell your name, location, comments and photos to 3rd parties.

Boeing (BA) is raising its quarterly dividend 10% and is buying back $3.6B in stock.

Nielson (NLSN) is buying Arbitron (ARB) for a 25% premium over yesterday’s closing price.

Sanderson Farms (SAFM) is up almost 5% in premarket…earnings related.

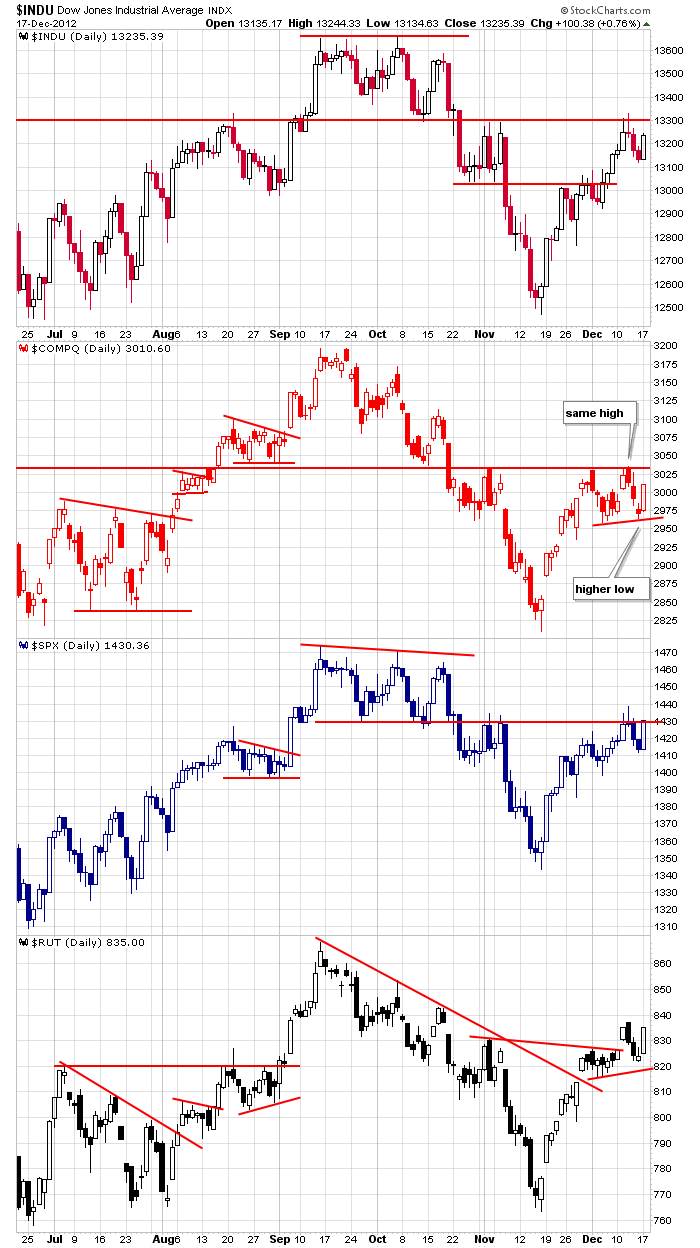

Here’s an update of the daily index charts. With the Nas matching its previous high and then registering a higher low, it’s setting up in an ascending triangle pattern in the middle of its September high and November low. The Dow, S&P and Russell have made higher highs and higher lows for about four weeks, and yesterday’s candle makes last week’s weakness look like innocent pullbacks within uptrends. There’s still lots of resistance overhead, and with the market pricing in a fiscal cliff agreement, we have to start thinking about the possibility of selling pressure, not buying pressure, after an agreement is officially made.

I remain cautiously optimistic. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 18)”

Leave a Reply

You must be logged in to post a comment.

I don’t think the algo programers know the old trading adage, “sell on the news”….

to me the above charts all look like short term reverse head shoulders

but that would be normal if the right shoulder of a longer term down bearish h/s was forming

is obarma for real

he wants more debt and a raising of the debt ceiling

for those that beleive in longer term cycles

fri 21st like changing from winter to summer a new cycle starts with the alinement of the galaxy

debt ,insanity,criminality,coruption,selfishness will be exposed and a new cycle of spiritual awearness will evolve

i expect the market to explode up till friday and die

however i am only any good at predicting intraday moves

so dont beleive a word i say

the word dicotomy definded —

one thing divided into positive and negative

its all to do with energy and magnatisum

perhaps the magnatium of earth will change with a new game for all,to evolve