Good morning. Happy Friday.

The Asian/Pacific markets closed up across-the-board. China led the way followed by Australia, India, Indonesia, Japan, South Korea and Taiwan. Europe is currently mostly down. France and Austria are suffering the biggest setbacks followed by Germany, Norway and Greece. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil and copper are down slightly. Gold and silver are down.

The market dropped a bunch yesterday when “we’re going over the cliff” comments emerged from Washington, but then it staged an impressive comeback when the Speaker said the House would meet Sunday night. It’s all about the fiscal cliff right now. Good news is sending stocks up; bad news is sending them down. Simple as that. A deal will be agreed on sooner or later. The question is how long this thing gets dragged out and how much damage is done before it finally happens.

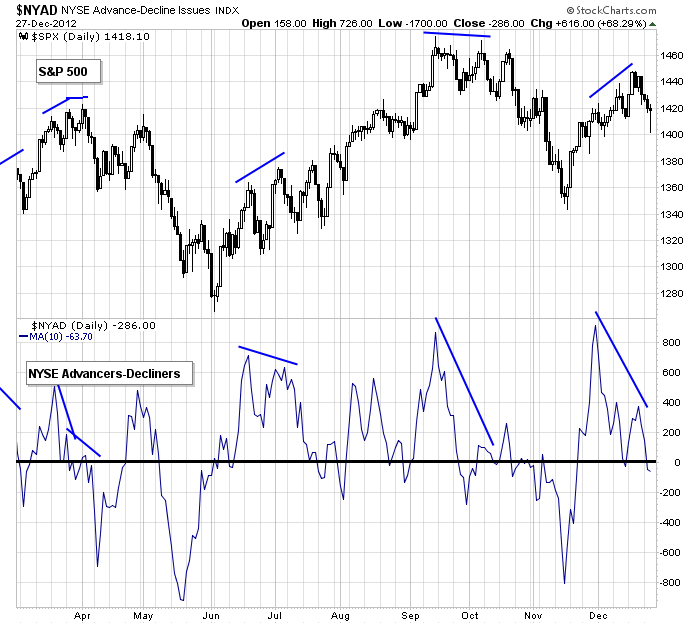

Everyone will blame Washington for the market’s recent weakness – and rightfully so – but there’s no guarantee the market will rally as soon as an agreement is forged. There are several warnings brewing beneath the surface that have me thinking we may get a “sell the news” situation…or perhaps a “sell the news” after an initial knee-jerk rally. Here’s the S&P vs. the 10-day MA of the AD line. We got a negative divergence heading into this week and a new closing low yesterday. While everyone focuses on the fiscal cliff, there are intermediate term indicators which are hinting at some problems under the hood.

Play good defense. Don’t be a hero.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers