Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. China, South Korea and Indonesia rallied more than 1%; Australia, Japan, Singapore and Taiwan moved up more than 0.7%. Europe currently leans to the downside. Switzerland is up big; France and the Czech Republic are down. Futures here in the States point towards a flat open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

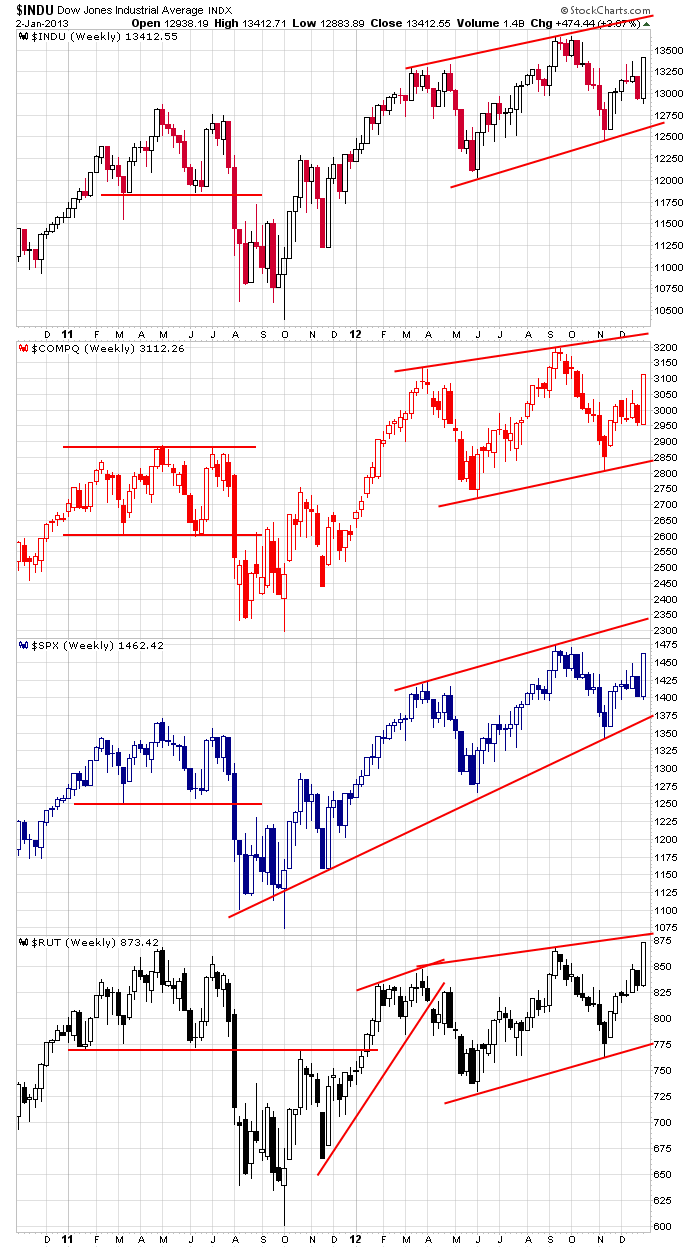

The last two days have combined to be the biggest 2-day gain in a very long time. The S&P is up an amazing 60 points, so the Santa Claus indicator is in very good shape right now. Here are the weekly charts…very bullish candles, and that’s an all-time high for the Russell small caps.

But as talked about yesterday in the daily report, the market is not without warnings. The AD line isn’t in horrible shape, but it is lagging. New highs spiked – exactly what happened at the September high. And the ATR is moving up – higher volatility hints at limited upside.

There isn’t must company-specific news out.

Gap (GPS) same-store sales were up 5%…they’re repurchasing $1B in stock…they’re buying Intermix for $130M.

Hormel (HRL) is buying Skippy Peanut Butter from Unilever (UL).

Macy’s (M) same-store sales rose 4.1%.

Target (TGT) same-store sales were flat.

Family Dollar (FD) is down 8% premarket…missed profit view.

Limited (LTD) same-store sales up 3%.

Initial jobless claims moved up 10K…it’s the 4-week moving average, which is more important, was basically flat.

That’s it for now. Stay on your toes. The price action looks good, but there are a few warnings beneath the surface. We still don’t know the move of the last two days was just a knee-jerk reaction to the fiscal cliff deal that will be faded or the start of a new bull run. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 3)”

Leave a Reply

You must be logged in to post a comment.

Comments are slim pickings Jim…….First comment for the year !