Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly down. India, Indonesia, Japan and Taiwan were noticeable losers. Europe is currently trading mixed and with a bearish bias. France, Germany and London are down the most. Futures here in the States point towards a slight down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are flat.

I don’t have anything to add to the comments I made over the weekend in the weekly report. I like the price action overall, but in the very near term I would not be surprised to see a pause or a little correction because a few indicators hit extreme levels.

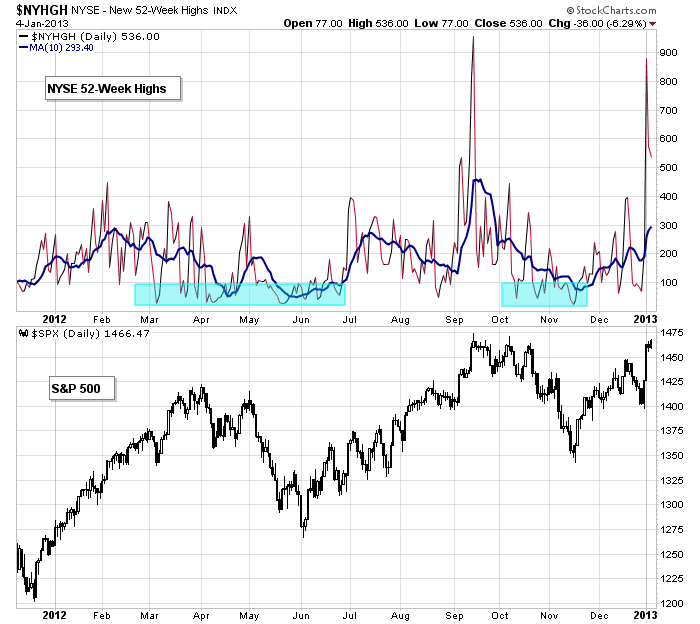

New highs spiked. In the past this has led to some profit taking.

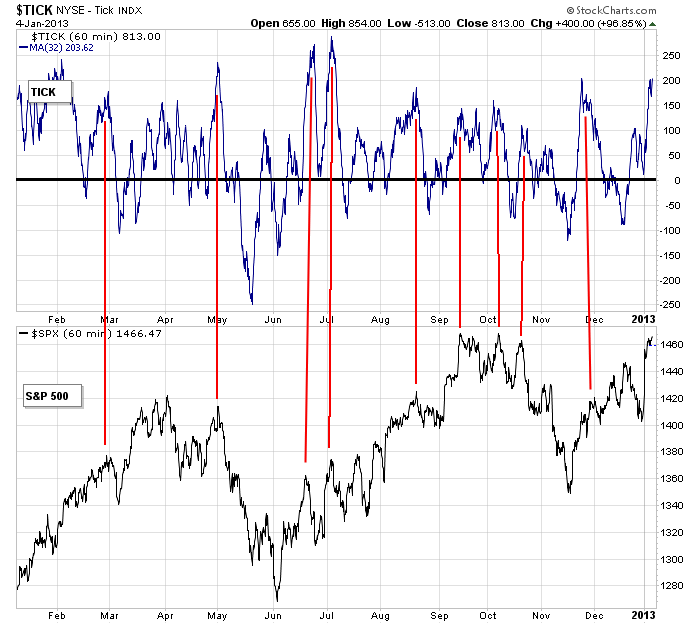

The TICK is at a high level, and when it rolls over, it’s also likely to led to profit taking.

But as of now, I think a pullback gets bought. I don’t seem much underlying weakness overall.

Athenahealth (ATHN) is buying Epocrates (EPOC).

Bank of America (BAC) is paying $3.6B to Fannie Mae to settle claims related to residential mortgage loans for the nine years to the end of 2008. BAC is also selling its mortgage servicing rights to Walter (WAC) and Nationstar (NSM).

The Santa Claus Indicator was positive this year. Now we’ll see how the January Indicator shapes up. And earnings season is right around the corner. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers