Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Australia, China, Hong Kong and Japan did well. Only India dropped noticeably. Europe is currently mostly down. Austria, France, Germany, Norway, London and the Czech Republic are posting the biggest losses. Futures here in the States point towards a moderate gap down for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are up.

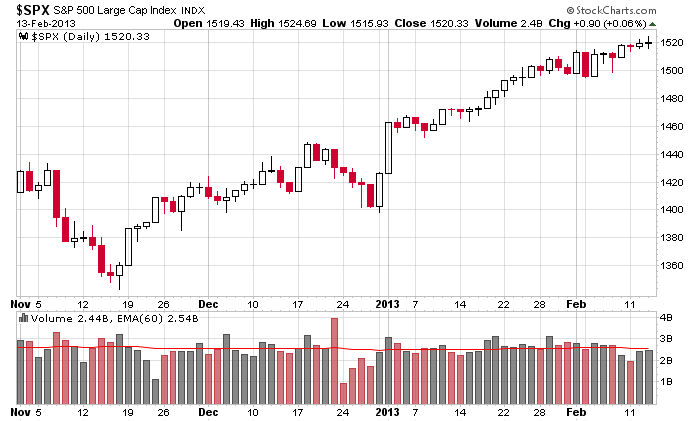

Here’s the SPX daily. Last Friday and Monday it moved up on declining volume. Then the last two days volume picked up, but the upside price progress was very little. Neither scenario is very bullish…moving up on light volume or basically churning in place on higher volume. Does it matter? The market has ignored everything the last month.

By itself, the extent of the rally off the November low is not a surprise – the market is fully capable of such upside progress. The surprising thing is the steadiness and consistency. Other than a move down on very light volume at the end of 2012, the market has barely pulled back. Every little dip gets bought. If you’ve been waiting for a buy-able dip, you are probably pretty frustrated right now because one hasn’t materialized. If this describes you, send me a quick email when you decide to throw all caution to the wind and buy because that’s when the market will top. Is this harsh? Yeah. Sorry, that’s the way Wall St. works. Rallies don’t let you in; sell-offs don’t let you out. Sooner or later you’ll realize playing guessing games is not wise. Read the charts and trust them.

Given this, the risk/reward for chasing stocks higher right now is not good. Building gains on top of gains is hard. Play the best charts only. Shoot for singles and the occasional double. Don’t give profits back. I get the sense a decent move is coming. We could get a blow-off top that brings the last of the bears over to the bull’s side or a quick move down that catches the “market never drops” bulls by surprise. Be on your toes. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 14)”

Leave a Reply

You must be logged in to post a comment.

I like your earlier post. By the way,

what’s up with your electricity ? Es

Electricity is back on. The guy who owns the complex didn’t pay the bill, so they turned it off. Much different than the States where they have to send you 6 months of warnings before flipping the switch.

“if this describes you, send me a quick email when you decide to throw all caution to the wind and buy because that’s when the market will top.”

Sorry Jason experience has made me wise and it won’t happen.

I wrote models to keep me from doing emotional trading. That said I got a buy signal on Feb 4. I did not even look at the buy model! One who gets emotional with the market loses.

Paul