Good morning. Happy Tuesday.

The Asian/Pacific markets closed down across the board. Australia, China, Hong Kong, India and Singapore dropped more than 1%. Europe is currently down across the board. Austria, France, Germany, Amsterdam, Stockholm, Switzerland, London and Czech Republic are suffering sizable losses. Italy is down 4.6%. Futures here in the States are pointing towards a slight up open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

Bernanke gives a semi-annual testimony on monetary policy. Given the FOMC Statement and follow up Minutes, it’ll be interesting to see what he says.

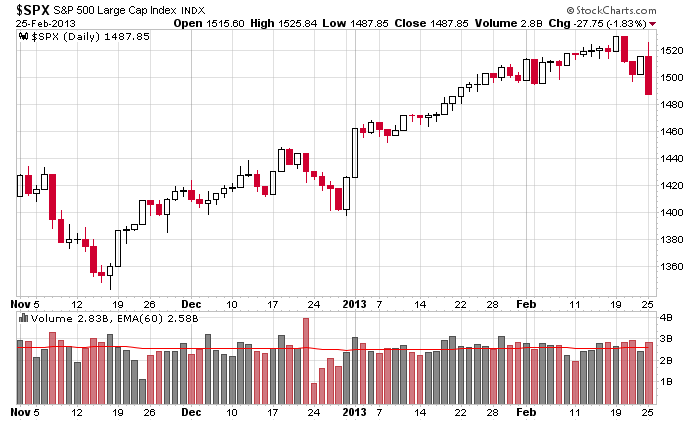

Here’s the S&P daily chart. Ugly action recently. Last Wednesday’s was the market’s single worst day since it bottomed in November. Volume increased on the follow up day Thursday. A light-volume bounce was then followed by a down day yesterday which was far worse than last Wednesday. With the market moving down on high volume and up on lighter volume, it’s hard to justify being long. I’ve been saying it for a couple weeks…you must manage positions wisely. If you buy a stock at 30 and have a target of 34 and the stock only makes it to 33 before the market experiences heavy selling pressure, take profits. Forget your target, forget your stop. Just take profits.

Given this I’d still be surprised if the market just dropped and dropped and dropped and didn’t make at least one rally attempt to the highs. Tops usually don’t form in single days, which is how bottoms often form.

Don’t argue with the market. When you go long for several months, and trading is generally pretty good, it’s hard to change your tune but you have to. You cannot dig your feet in and force the market to do what you want. Trading is a game of follow the leader, and you’re not the leader. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 26)”

Leave a Reply

You must be logged in to post a comment.

“Don’t argue with the market.”

Good advice. Never argue with a fool. A fool is incapable of rational thought and someone walking by would not know which one of you is the fool.

Paul

options control the world,not shares that are just pawns

mar quad witch could be interesting

insto hedge funds–marketmakers-bookmakers take the opposite side to the irrational exhuberance of the long only funds and investors bull that we recently saw

so the instos needed a pull back and the suckers to buy protection

has enough protection been sold /bought yet