Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. India dropped 1.5%; Japan rallied 2%, China 0.8%. Europe is currently mostly down. Greece is down 2.9%; Austria and France are down 0.5%. Futures here in the States point towards an up open for the cash market.

The dollar is flat. Oil is up, copper down. Gold and silver are down.

Yesterday the market suffered its biggest single day loss in three weeks, but as a testament to how strong the market has been lately, the S&P only dropped 0.6%. And the close was well off the LOD (low of the day).

Yesterday the world markets reacted negatively to the Cyprus bailout news. Then the US shrugged off the news and traded close to flat on the day before dropping in afternoon trading. Now the Asian markets are mostly up and Europe leans slightly to the downside. You see this all the time. It takes a full 24 hours for news to be digested, and often the initial reaction is the wrong one.

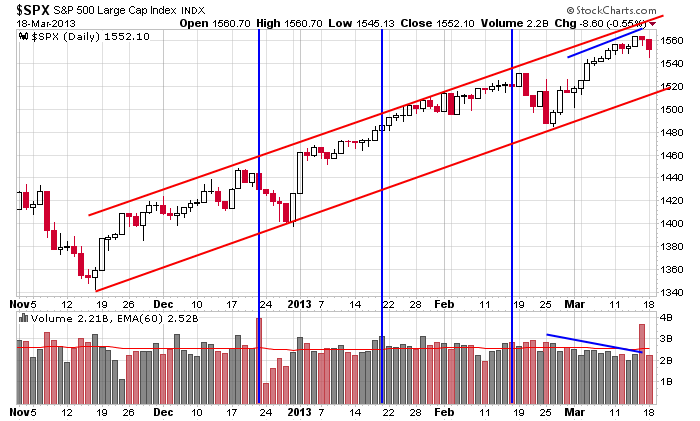

In the grand scheme of things yesterday didn’t change anything. The long and intermediate term trends are solidly up. The very short term is more neutral, but this has as much to do with the extent of the rally over the last three weeks as anything. Here’s the daily S&P chart. I stated last week that the market was so strong, a 50-point pullback would not change the trend. I still believe this. Plus, the two most recent corrections played out right after options expired (indicated with the vertical blue lines).

For now we keep doing what we’re doing. Play the best set ups in the best groups and play good defense.

Meredith Whitney says she never been this bullish on US equities in here career. Hmmm. Hey Whitney, how’s the bearish municipal bond trade working out?

FOMC is tomorrow. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 19)”

Leave a Reply

You must be logged in to post a comment.

I did not get this email about today’s before the open until 12:30 CDT in the great state of Michigan. That said the market is falling and a great time to keep your shorts.

I got it late too. Campaigner is owned by j2 Global (JCOM) and headquartered in CA, not Costa Rica as Neil wants you to believe. 🙂