Good morning. Happy Wednesday. Happy Fed Day.

The Asian/Pacific markets closed mixed. China dropped 1%; Hong Kong, South Korea and Taiwan did well. In Europe, London rallied 0.7% while the rest of markets were closed for a holiday. Futures here in the States point towards a positive open for the cash market.

The dollar is down. Oil and copper are down. Gold and silver are down.

Today is Fed day. It’s the day the FOMC targets the overnight rate (the rate at which banks borrow money from each other) and the discount rate (the rate at which banks borrow from the Fed). No changes are expected, but as has been the case the last couple meetings, their statement will be closely read for clues regarding the possible end to their QE operations. I don’t expect any change. I think the Fed is likely to do too much QE than too little. Besides, they’ve already stated they’re keeping rates low until the unemployment rates drops to 6.5%, and that’s not happening for a while. Commodity prices have perked up a little lately but not enough for inflation to be a real possibility.

Exports in South Korea registered 0.4% year-over-year growth vs. consensus expectations for 2.0%. The number is considered an economic canary in a coal mine for Asia because of its exposure to Japan and China.

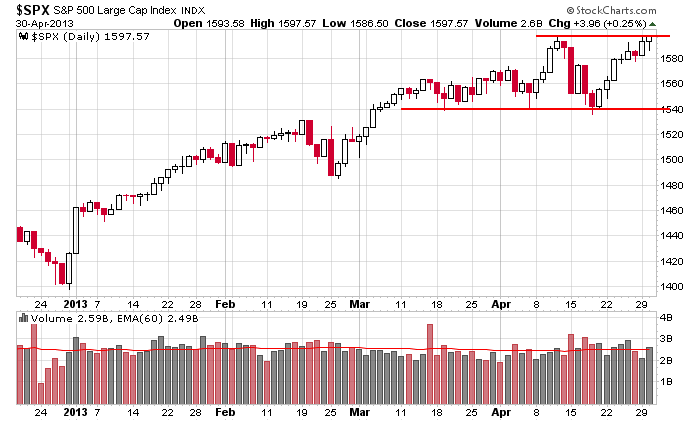

Here’s the S&P daily. It’s been range bound in a 60-point range for two months…nothing wrong with this. It’s moved up 7 of 8 days and is now at an all-time high. For a technical standpoint, I’d rather not see a breakout right now. It’s rallied too much the last week to expect the index to be able to tack gains on top of gains. I’d prefer a rest.

The long term trend remains solidly up. The intermediate term trend is neutral. As a swing trader who plays the bigger swings, my bias is certainly to the upside.

The market is likely to be slow ahead of the Fed. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 1)”

Leave a Reply

You must be logged in to post a comment.

if i take out a trial sub can i come down to costa rica and spend the weekend? (; you should do a ebook on your expatriation gig. let me know i can pack in a couple of hours .. (:

LOL…I have way too many things to do…write an ebook about moving to Costa Rica is not on the list. 🙂

When unemployment approaches 6.5% all of the people who have not even looked for work for years will start looking.

Yeah the unemployment figures involve lots of funny math.

The ADP jobs was 115K services, Manufacturing was off while homebuilding was UP. No shocks there pure stimulus results, The S. Korea export data is a caution: Asia is feeling weak, watching Australia, EWA, which is tied to China – closely. The other small economies in the ASIA region are also in stall mode. Did you hear about EU?

Jason’s bias up is his business, but feasible only so long as the FED keeps the hose running.

Caution in May is not a mistake especially with margin debt at new highs, earnings

of reported firms down. When Obama care is loosed in summer things will tighten up.

the fed will soon realise that it has created a derivitives bubble of hot air

and that the galaxy is once again at the mercy of the to big to fail insto gamblers

is uncle ben from mars

is obanana a space invader from another galaxy