Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Australia, Hong Kong, Indonesia, Singapore and Taiwan did well. Europe is currently mostly up. Greece is up 7.4%; Stockholm, Austria, France, Germany and Switzerland are also doing well. Futures here in the States suggest a flat open for the cash market.

The dollar is down. Oil is down slightly, copper is up. Gold is up, silver is down.

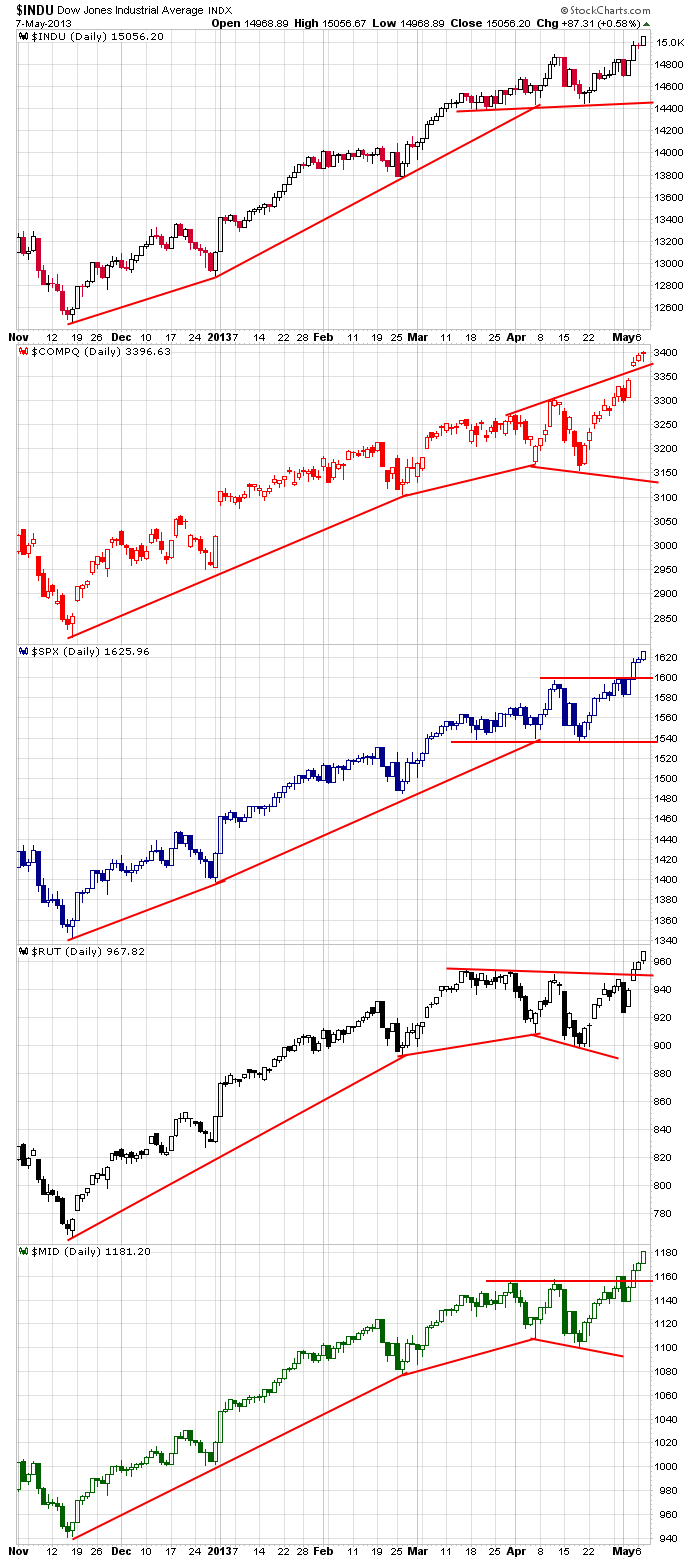

The indexes continued to climb yesterday. The S&P has rallied 11 of 13 days and is 85 points off its low hit just a couple weeks ago. Except for the Nas and Nas 100, all the indexes closed at new all-time highs. Here are the daily charts. We’re in no-man’s land.

No matter how you pick up the market and spin in different directions, the only conclusion you can reach is that the trend is solidly up. Period. With so many TV stations covering the market, hundreds of newspapers and magazines, thousands of websites, it’s easy to get carried away and over-analyze every little move, every little nuance, every little everything. But sometimes you gotta call a bull market a bull market and stop asking questions.

The current rally won’t continue much longer without taking a break. But a break will be a chance to dump laggards in exchange for new set ups that have greater potential going forward.

For those who say the market is floating higher because the Fed is flooding the market with money, I agree with you. The growth we’re seeing isn’t organic, and at some point in time the Fed will raise rates and start to ease off accommodation. Until then, don’t fight the trend. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 8)”

Leave a Reply

You must be logged in to post a comment.

Go with the flow, but be conservative about stops and seasons, and respectful of what the Fed can do to human emotions just a marvel to watch. The EU is in god awful condition. My trip to Paris over the weekend made me hesitant to own anything in the EU. The French are hurting due to lack of jobs, high taxes and falling trade with everyone save Poland. The Japanese markets are looking better the more reckless Abe becomes. China says its exports and imports were just fine and growing, if you believe. All in all, we are cautious and enjoying the weather – sailing Puget Sound up to Canada is the mark of NW summer.

the above charts jaws of death are coming to get mr fed ponsi

then mr fed ponsi will be eaten all up and consumed in its own arrougance

and in jail for treason along with its other big bank instos that own the fed

same for other central banks and japan to impload

dont be a bull be a bear

Jason is happy when im a bear

be a broadening pattern and distribute to the bulls

alert——-

next the greatest bear market on earth

well worth $15 for the greatest short of all time

the demise of the fed and bankruptcy and banning of all central banks

following the cancellation of all money will the invention of replicators as

seen on star treek

making money thus shares redundent