Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. India dropped 2.3%, and Indonesia dropped 1.2%. Japan rallied 1.4%, and New Zealand moved up 0.9%. Europe is currently trading mostly down. Amsterdam, Stockholm, Switzerland, London and the Czech Republic are down the most. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

After going on a pretty good winning streak the last week of April and first couple weeks of May, the market has traded range bound the last week+. In fact over the last 12 days the market has moved up 6 days and moved down 6 days. We’ve gotten several moderate gap opens and several long tails on the daily candles. This is much different than the calmness that took place during most of the previous couple months. It doesn’t mean a top is being established (are the bears going to guess wrong yet again), but it does make trading a little more risky. Dips are still being bought but not necessarily on the same day they occur.

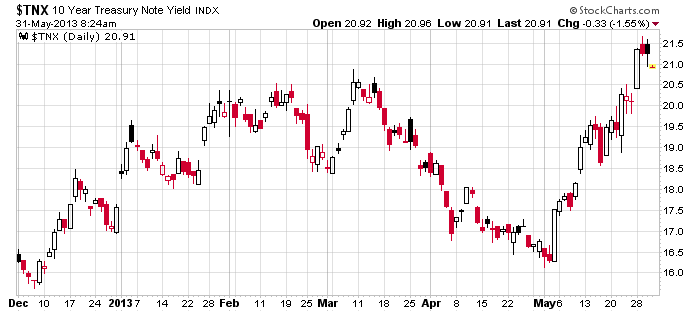

The biggest headwind the market must deal with right now is the bond market. It has sold off the last month, so yields have moved up. The bond market is competition for the stock market. The higher yields go, the stronger the urge to transfer money out of stocks and into bonds. Here the 10-year yield.

I’ll talk more about bonds this weekend.

For now, the trend remains solidly up, and charts of individual stocks are much improved this week. I’m only interested in the long side but am not being overly aggressive.

Here are stock-specific news stories from barchart.com…

UBS believes Harley-Davidson’s (HOG -0.11%) April U.S. retail sales are down about 10% at the dealer level, which is worse than expected.

Canadian National (CNI +1.24%) was upgraded to “Neutral” from “Underweight” at JPMorgan.

Jazz Pharmaceuticals (JAZZ +3.17%) was initiated with a “Buy” at Stifel with a target price of $80.

Perfect World (PWRD +2.10%) was upgraded to “Outperform” from “Neutral” at Macquarie.

Reuters reported that Samsung picks the Intel (INTC -0.25%) “CLover Trail” processor for its upcoming Galaxy 3 Tablet.

United Technologies’ (UTX +0.88%) Sikorsky Aircraft is awarded a $435 million government contract modification to procure four CH-53K System Demonstration Test Article aircraft.

CEMEX (CX +1.76%) announced that it plans to expand the production capacity at its Odessa, Texas cement plant by 345,000 metric tons to nearly 900,000 metric tons per year in order to keep pace with rapidly growing demand in its West Texas market led mainly by the oil and gas industry.

Deutsche Bank upgraded Morgan Stanley (MS +3.36%) to “Buy” from “Hold” and raised its price target for the stock to $30 from $20.

OmniVision (OVTI +2.86%) spiked nearly 16% higher in after-hours trading after it reported Q4 adjusted EPS of 31 cents, well ahead of consensus of 21 cents.

Krispy Kreme (KKD +5.47%) climbed nearly 10% in after-hours trading after it reported Q1 EPS of 20 cents, better than consensus of 17 cents, and said same-store-sales were up 11% in the first 3 weeks of May.

Orange County of California awards SAIC (SAI +0.66%) a $102 million IT services contract.

Guess (GES +0.65%) rose over 7% in after-hours trading after it reported Q1 adjusted EPS of 14 cents, better than consensus of 8 cents.

Lionsgate (LGF -1.44%) is up over 2% in after-hours tradsing after it reported Q1 adjusted EPS of 66 cents, better than consensus of 44 cents.

Esterline (ESL -2.59%) reported Q2 EPS of $1.12, lower than consensus of $1.25, and lowered guidance on fiscal 2013 EPS to $5.30 to $5.50, weaker than consensus of $5.58.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 31)”

Leave a Reply

You must be logged in to post a comment.

we now have a downtrend

but may get a wave 2 counter trend bounce next week and new month

but which funds would be stupid enough to buy