Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. China rallied 2.2%, Hong Kong and Indonesia more than 1%. Europe is currently mostly down. Austria and Greece are down more than 2%, Spain and Italy more than 1%. Futures here in the States point towards a down open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

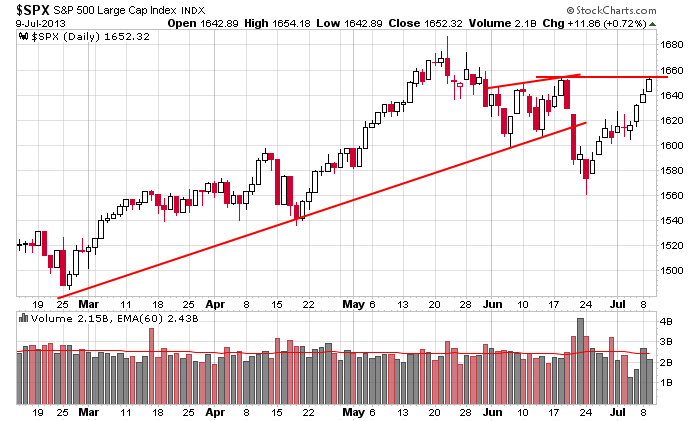

The S&P has moved up 8 of the last 10 days. The Russell 2000 is sitting at a new all-time high. The S&P 400 isn’t far behind. The other indexes have recaptured their post-FOMC losses. Many indicators, such as the AD line, AD volume line, new highs, put/call ratio and average true range, are supporting the current uptrend. The market got a little scare from the Fed and from negative news from China, and all it did was hiccup for a few days. Let’s not get carried away. We still need to manage trades wisely, but for now the market has easily neutralized its bearish sentiment so the odds favoring a summer sell-off are significantly reduced.

Here’s an update of the S&P daily. The indexes did a bump-n-run (that’s where its trend suddenly increases in slope before dropping to take out the trendline), but the selling didn’t last. Now it’s recovered its losses, and although short term sentiment is very positive, the intermediate term is neutral.

Here are stock-specific headlines from barchart.com…

Wells Fargo (WFC -0.30%) was downgraded to “Hold” from “Buy” at Sandler O’Neil.

Moody’s Investors Service raised its outlook of the U.K. banking system to stable from negative, citing improving profitability and lower impairments.

The WSJ reports that investors pulled $13.5 billion from mutual funds that invest in municipal bonds in June, according to Lipper FMI, a retreat that is making it harder for several cities, states and towns to raise money.

Family Dollar Stores (FDO -0.48%) reported Q3 EPS of $1.05, better than expectations of $1.03, and raised guidance on fiscal 2013 EPS to $3.77-$3.82, higher than consensus of $3.77.

Cummins (CMI +1.62%) raised its quarterly dividend 25% to 62.5 cents per share from 50 cents per share.

Fastenal (FAST +2.46%) reported Q2 EPS of 41 cents, right on expectations, but then boosted its dividend by 5 cents to 25 cents per share.

Amazon.com (AMZN +0.32%) was initiated with a “Buy” at Citigroup with a price target of $340.

eBay (EBAY +1.45%) was initiated with a “Buy” at Citigroup with a price target of $65.

Google (GOOG +0.02%) was initiated with a “Buy” at Citigroup with a price target of $1100.

Helen of Troy (HELE +2.14%) gained over 3% in after-hours trading after it reported Q1 EPS of 82 cents, well ahead of consensus of 71 cents, and raised its fiscal 2014 EPS view to $3.50-$3.60, better than consensus of $3.53.

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Jul 10)”

Leave a Reply

You must be logged in to post a comment.

China is faltering, that has its Asian suppliers worried. And today the Fed says something. The EU is mixed (bad to terrible) and the Euro is going to 120, 128 this AM. In the meanwhile the no volume US rally lead by the R2K plunges ahead. I still hold long index etfs, watching gold and silver to start a short covering rally of substantial proportions, 1320-1530, and the bonds rise on firm belief the Fed will stop its QE. Probably not yet. The rise in bonds is killing the housing recovery and refinance. Do believe anything until you see it happening, and then believe only enough to watch for a trend. Worst market I have seen in 50 years. This is a banking driven rally that can end any time.

Strange how it can be the worst market for some and best market for others. Perhaps, since I am not a short term trend follower. As for the housing recovery, remember when mortgage rates were well over 10%?