Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. China and Hong Kong were noticeable movers to the downside; Indonesia and Taiwan moved up. Europe is currently mostly down. Belgium is up while Germany, Stockholm, London, Spain and the Czech Republic are down. Futures here in the States point towards a flat open for the cash market.

The dollar is up. Oil is up, copper down. Gold and silver are down.

As of now the S&P is sitting on its biggest weekly gain since December. The index has moved up six straight days and of 10 the last 12 and is about 115 points off its recent low.

The Russell is at an all-time high. The Nas is at its highest level since the dot com bubble days. The mid caps are only few points from its own all-time high.

It looks like the post-FOMC plunge was a big shake out. After a couple days of selling, it’s been up, up and away, and even my conservative “the market is likely to trade in a range” opinion seems too conservative right now. In the past I’ve been accused of being a perma bull, but even I haven’t been bullish enough. 🙂

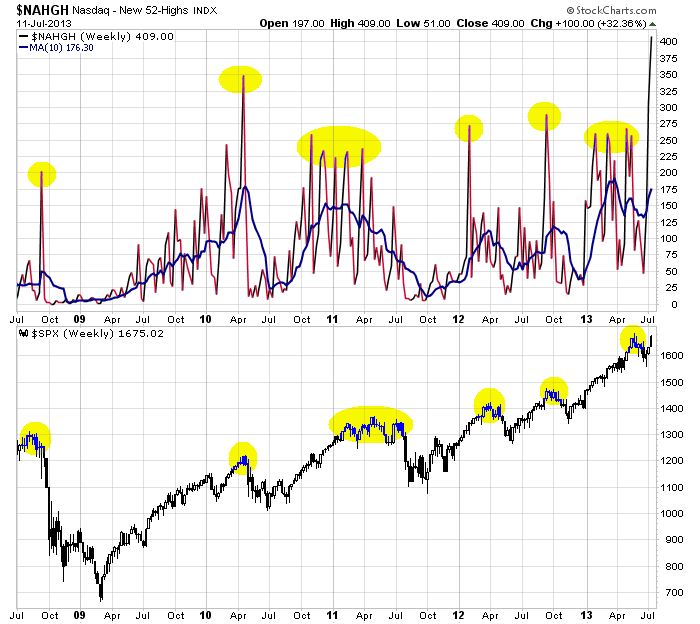

The market’s run has put several indicators at very high levels. New highs at the Nas is one. It’s currently sitting at its highest level in several years. Spikes in the new highs have produced small local tops. It’s something to keep an eye on. This development tells me a range is much less likely to happen. It’ll either lead to a pullback or is just the beginning of a big move up.

Here are stock-specific headlines from barchart.com…

Regeneron (REGN +4.72%) was upgraded to “Buy” from “Neutral” at Lazard Capital with a price target of $298.

Kroger (KR +1.21%) was downgraded to “Sell” from “Neutral” at Goldman.

Hormel Foods (HRL +2.06%) was upgraded to “Outperform” from “Market Perform” at BMO Capital.

Both Pfizer (PFE +1.16%) and Bristol-Myers (BMY +2.61%) were downgraded to “Hold” from “Buy” at Jefferies.

Apollo Group (APOL +6.04%) was downgraded to “Equal Weight” from “Overweight” at Barclays.

Xilinx (XLNX +1.68%) was upgraded to “Buy” from “Neutral” at Citigroup who also raised their price target on the stock to $50 from $40.

JPMorgan Chase (JPM +0.57%) reported Q2 EPS of $1.54, better than consensus of $1.45.

The Verge reported that Microsoft (MSFT +2.85%) is planning to cut the price of its Surface RT tablets by $150 off the price of each model in a move that could occur as soon as next week.

Valero Energy (VLO +2.95%) fell over 4% in after-hours trading after it warned that it sees Q2 EPS with-items 80 cents-90 cents, below market consensus of $1.27, due to significantly lower discounts for heavy sour crude oil, higher natural gas costs, higher costs to comply with the Renewable Fuels Standard, and turnaround and maintenance activity at the Quebec City, McKee, Meraux, and Port Arthur refineries.

Glenhill Advisors reported a 5.0% passive stake in Pep Boys (PBY +0.98%) .

Carl Icahn said he will present a higher bid for Dell (DEL +1.44%)L Friday morning. Icahn stated that the bid will be vastly superior to Michael Dell’s bid to bring the company private and that his new bid will include “a warrant around $20 a share.”

Gap (GPS +1.50%) rose nearly 1% in after-hours trading after it reported that June net sales increased 8% y/y.

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Jul 12)”

Leave a Reply

You must be logged in to post a comment.

Jason,

Yep, congrats whoever bot the June dips!

Helicopter Ben swoops down, then soars high and the crowd ‘roars’ !!

Keeping my index/sector hedges in place and moving slowly into silver and a little gold. What is with crude moving up? The canal and Egypt? The ETF sector leaders recently: XLB XLK XLI XLU XLY. Fed do something? Cheers.

im a very lonely bear

muma and pupa bear come from mars

and i have to wait till the market crashes to zero to go home