Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

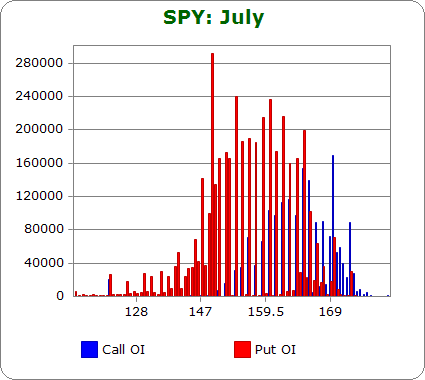

SPY (closed 168.22)

Puts out-number calls 1.9-to-1.0 – less bearish than last month.

Call OI is highest between 160-166 and then at 170.

Put OI is highest between 147-166.

There’s some overlap between 160-166, but since puts dominate at every level, expiring more puts worthless should be the market’s objective. A close in the upper half of the 160-166 range will accomplish the mission. Today’s close was at 168.22 – above where it needs to be. So a moderate move down the rest of the week is needed.

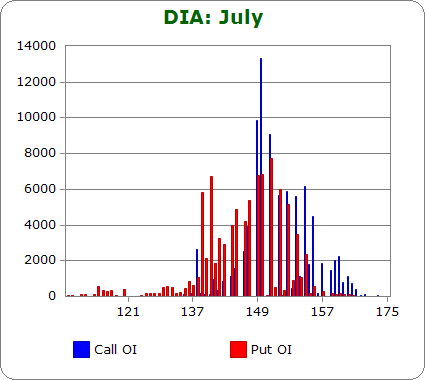

DIA (closed 154.58)

Puts out-number calls 1.1-to-1.0 – less bearish than last month.

Call OI is highest at between 149-151, and then there are couple moderate OI strikes just above these levels.

Put OI is highest at 139, 141 and between 149-152

There’s no reason to talk about these numbers. DIA call OI is 155K; call OI for SPY is 4.58M – 30x greater. DIA numbers, for the purpose of determine what level the market needs to close at to cause max pain, are useless.

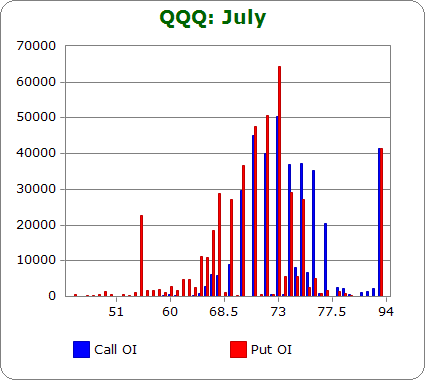

QQQ (closed 75.46)

Calls out-number puts 1.4-to-1.0 – more bearish than last month.

Call OI is highest between 71-76 and at 85.

Put OI is highest between 70-73 and at 85.

There’s lots of overlap here. A close in the middle of the biggest OI spikes (71-73) would expire the most number of calls and puts worthless and minimize the profit eleswhere. With today’s close at 75.46, QQQ is higher than ideal. We need a move down, otherwise some of those call buyers will profit “too much.”

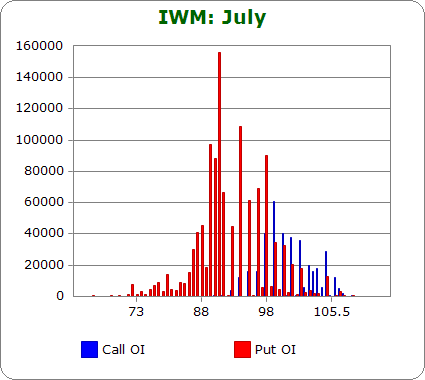

IWM (closed 103.62)

Puts out-number calls 2.7-to-1.0 – less bearish as last month.

Call OI is highest between 98-100.

Put OI is highest between 90-98.

There’s virtually no overlap between the highest call and put OI levels. A close at 98 would expire most options worthless. Today’s close was at 103.62 – well above the ideal level. As of now a move down is needed to cause max pain.

Overall Conclusion: Thanks to a big move up last week, the market is higher than it needs to be if it is to cause max pain among option buyers. A move down the rest of the week is needed.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

Has anyone documented over a period of time the relationship between these calls and the market at options expiration? What percentage of times do they relate?

Typically, several days before expiration, the market is already sitting where it needs to be to cause max pain. This week is an exception. In my opinion, this report doesn’t offer actionable info. Other things are more important.