Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. India and Indonesia lost about 1%; New Zealand, South Korea and Taiwan did the best but none of the markets gained 1%. Europe is currently up across-the-board. France, Germany, Stockholm, Switzerland, Italy, Spain and the Czech Republic are leading. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up slightly. Oil is flat; copper is up. Gold and silver are down.

The tech sector has been lagging lately, so it’s worth mentioning AAPL did well with earnings yesterday after the close. The stock is up almost 5% in premaret trading.

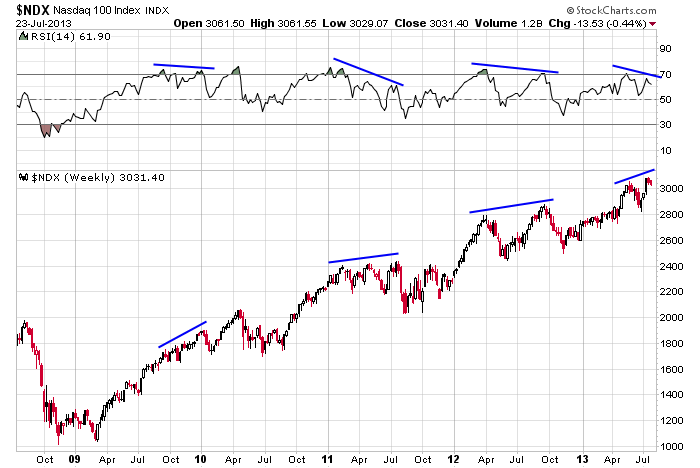

Perhaps AAPL can improve sentiment within the sector, which may help the Nas 100 negate the negative divergence shown below.

Otherwise the market is beyond technical analysis. Overbought can stay overbought for a long time. Trendlines right now have little meaning. Normally a chart graphically tells us what’s going on in a stock, and trendlines tells us where buyers and sellers are likely sitting. But not right now. The market is on a mission right now. Your best course of action is to continue playing the long side while noting the risk/rewards are not great, and the run will come to an end sooner or later.

Don’t over analyze. Recognize every once in a while you need to lay your TA tools down and just let the market do its thing. Now is one of those times.

Here are headline stories from barchart.com…

Apple (AAPL) rallied sharply by 5% in after-hours trading yesterday after reporting Q2 EPS of $7.47, which was well above the consensus of $7.30.

Earnings reports released thus far this morning have mostly been positive but there were some high profile disappointments such as Boeing and Caterpillar. Notable reports include Reynolds American (RAI -1.99%) (0.84 vs 0.835), WellPoint (WLP +0.59%) (2.60 vs 2.08), Thermo Fisher (TMO -0.90%) (1.32 vs 1.30), Praxair (PX -0.01%) (1.49 vs 1.48), Wyndham (WYN -0.15%) (0.98 vs 0.91), Eli Lilly (LLY +0.71%) (1.16 vs 1.01), Northrop Grumman (NOC +0.36%) (2.05 vs 1.71), Pepsico (PEP -0.23%) (1.31 vs 1.19), Moody’s (MCO +0.68%) (1.00 vs 0.91), Ford (F -0.59%) (0.45 vs 0.37), Motorola Solutions (MSI +0.18%) (1.12 vs 1.04), Seagate (STX -3.23%) (1.20 vs 1.19). Negative reports this morning include Dr Pepper Snapple (DPS -0.29%) (0.84 vs 0.842), Allegheny (ATI +1.94%) (0.04 vs 0.12), AmerisourceBergen (ABC -2.31%) (0.73 vs 0.74), T Rowe Price (TROW -0.52%) (0.92 vs 0.95), Boeing (BA +0.87%) (1.41 vs 1.58), Caterpillar (CAT -0.56%) (1.45 vs 1.68).

Virtually all of the earnings reports released after yesterday’s close were above consensus. Notable reports included Robert Half (RHI -0.14%) (0.46 vs consensus of 0.43), Electronic Arts (EA -0.75%) (-0.40 vs -0.60), Juniper Networks (JNPR +2.84%) (0.29 vs 0.25), Discover Financial (DFS -0.33%) (1.20 vs 1.15), International Game Technology (IGT -3.12%) (0.33 vs 0.31), and Linear Technology (LLTC +0.57%) (0.43 vs 0.42). Companies that reported worse than expected results included AT&T (T +0.65%) (0.67 vs 0.68), and Norfolk Southern (NSC -0.66%) (1.46 vs 1.49).

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Jul 24)”

Leave a Reply

You must be logged in to post a comment.

The CAT data is a little troubling. CAT is the weathervane of global construction and it is saying a slowdown is coming. The run in precious metals has just started and will have pauses as it moves toward 1430 and maybe higher. The hedge fund business now has formal bank competition whether they know it or not. The GS,JPM,MS bank giants are now buying/warehousing commodities and of course the derivatives. Just part of lending you know, or do you know? I sure as hell did not. The Fed affirmed that they will not prevent this new meddling with the markets for commodities. You know if you control the inventories, you control the pricing. But it does add risk to the financial structure and to the cost of goods using commodities. We are fleas on the back of a giant hog living in a wonderland land some where in space.

I assume you’re talking about the Times article where GS has Al stock transported btn warehouses to delay shipment and thus drive up the price. Yes we are all just fleas on the hog.