Good morning. Happy Friday.

The Asian/Pacific markets closed mixed, and other than Japan (down 3%), none of the indexes moved much. Europe is currently mixed. Spain and Greece are leading to the upside; Switzerland is lagging the most. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is down. Oil and copper are down. Gold and silver are down.

So far it’s been a quiet week. The Nas is up 0.5%; the Dow, Russell and Mid are up very small amounts; the S&P is down a small amount. The ranges are small, and volume has been on the lighter side. We’ve gotten a moderate gap every day this week. Up Monday, Tuesday and Wednesday, down yesterday and today. Lots of spit swapping, lots of sudden reversals, very few slow, steady moves.

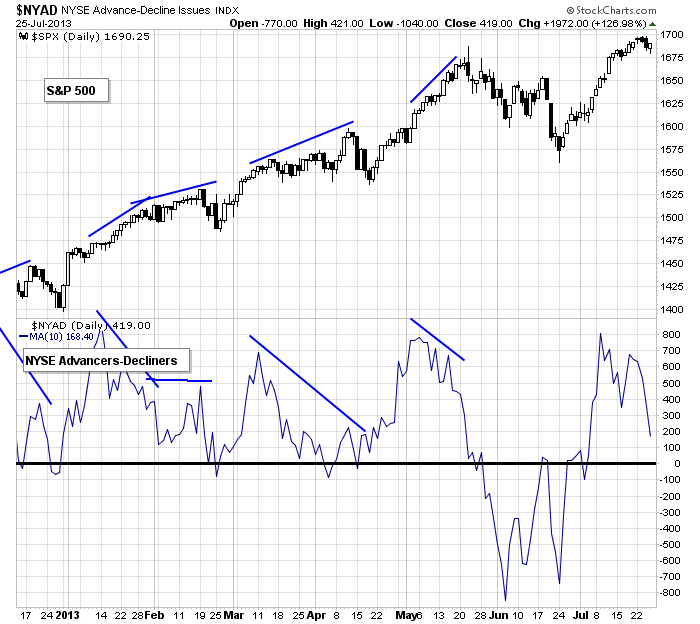

I’m starting to see more cracks out there…some negative divergences…some key stocks are lagging…it’s nothing major, nothing that suggests the market is going to take a big hit…but certainly things in the very near term are less clear.

Here’s an example…a divergence between the 10-day NYSE AD line and the S&P.

Don’t over-analyze. Don’t think too much. The longer term trend is still solidly up, but in the near term I think we have to be a little more careful.

I don’t have anything else to say right now…kind of drawing a blank.

Stock headlines from barchart.com…

Starbucks (SBUX +2.34%) rallied 7% in after-hours trading yesterday after beating earnings (55 cents vs 53 cent consensus) and raising its outlook.

Zynga (ZNGA +6.71%) fell 14% in after-hours trading yesterday after its earnings outlook disappointed.

Amazon.com (AMZN +1.49%) reported Q2 EPS of -2 cents, which was weaker than market expectations for a profit of 5 cents.

Earnings reports after yesterday’s close were mostly favorable with positive results including: Principal Financial Group (PFG +0.92%) (0.91 vs consensus 0.82), Chubb (CB +0.26%) (1.77 vs 1.38), VeriSign (VRSN +1.30%) (0.58 vs 0.55), McKesson (MCK +0.10%) (2.07 vs 1.71), Cliffs Natural Resources (CLF +0.44%) (1.07 vs 0.59). Negative late-afternoon results included Republic Services (RSG +0.09%) (0.43 vs 0.50), Expedia (EXPE +1.91%) (0.64 vs 0.81).

Earnings results this morning have been mixed. Positive results include Stanley Black & Decker (SWK unch) (1.21 vs 1.19), Tyco (TYC +0.60%) (0.49 vs 0.48), Helmerich & Payne (HP +0.94%) (1.44 vs 1.34), Newell Rubbermaid (NWL unch) (0.50 vs 0.49), and Aon (AON +1.00%) (1.11 vs 1.10). Negative results include Newmont Mining (NEM +1.08%) (-0.10 vs 0.42), Weyerhaeuser (WY +0.97%) (0.26 vs 0.30), DTE Energy (DTE +0.53%) (0.62 vs 0.77), and Ventas (VTR +0.28%) (1.01 vs 1.02).

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Jul 26)”

Leave a Reply

You must be logged in to post a comment.

Japan down 3% and Janet Yellen is likely at the Fed, more QE. USA housing starts have fallen off a cliff; they say down 19% see link below. Time to sharpen up the shorts?? Maybe. Still watching my dividend plays, they return 7% annually as a rule and that and a few equity plays, and you have a life. WSJ says Affordable Health Care is not. BSX is looking good for a run, and its cheap.

http://blog.kimblechartingsolutions.com/wp-content/uploads/2013/07/joefridayhomeconstructiondown19percentjuly25.jpg

yellmoreqe and trytouris summers that gave us repealed glasstegal are owned by wall street and are front runners so why not jamie dymontee

ron paul is my choice but volker or greenspan will do

daytrade–lol

my hedge fund indicators say dip and recovery

we may get a spike higher before down–at least today

maybe just to clean out the short stops

look at the dow close prices for this week –all just about same price

but its weekly opts ex and monthly opts for europe and oz ect

i am a member of genius elite and marsian t/a