Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Japan rallied 2.5%, China 1.8% and Hong Kong and Singapore also did well. Taiwan dropped 0.6%. Europe is currently mostly up. Austria, Belgium, Germany, Italy and the Czech Republic are up more than 1%. Futures here in the States point towards a big gap up open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are up.

The Fed spoke yesterday. The Committee said it was prepared to increase or reduce the pace of its bond purchases to maintain appropriate policy accommodation as the outlook for the labor market or inflation changes. It also said it anticipates exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent.

These are very dovish comments. Tapering is not a foregone conclusion. The Fed is giving themselves a way out should the market and economy turn down. They also made it very clear rates will be kept low beyond the time bond purchases are decreased.

The market was volatile after the news and ended up selling off into the close. But overseas markets cheered the news and rallied in response, and this is causing index futures to rally this morning.

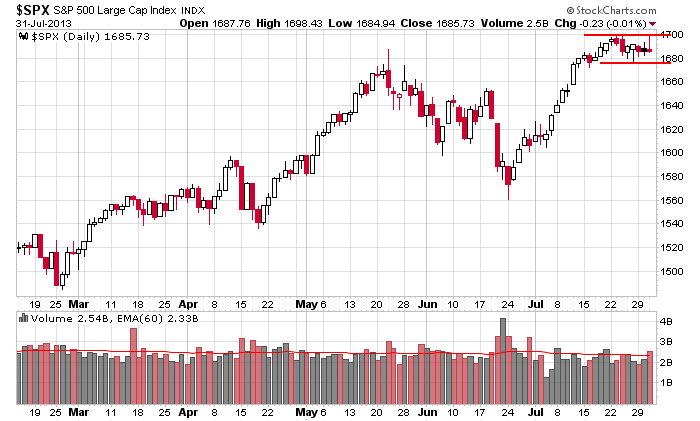

Here’s the current S&P 500 daily chart. On a very short term basis, we got an ugly candle yesterday – 5-day high followed by a high-volume sell-off and a close at the lows. But backing up a little we see a simple consolidation pattern within an uptrend. This pattern has bullish implications, but as pointed out in the video I posted over the weekend, there are indicators which need to be worked out.

My overall bias remains to the upside. On a very short term basis, I’m neutral. The consolidation pattern plus the declining indicators gives me pause in the near term.

Stock headlines from barchart.com…

CME Group (CME -0.11%) reported Q2 EPS of 93 cents, stronger than consensus of 90 cents.

Procter & Gamble (PG -0.17%) reported Q4 EPS of 79 cents, better than consensus of 77 cents.

Time Warner Cable (TWC -0.81%) reported Q2 EPS of $1.69, better than consensus of $1.65.

Iron Mountain (IRM +0.07%) reported Q2 EPS of 29 cents, weaker than consensus of 31 cents.

Cigna (CI +1.81%) reported Q2 EPS of $1.78, well ahead of consensus of $1.60.

Marriott (MAR +0.43%) reported Q2 EPS of 57 cents, right on consensus, although it reported Q2 revenue of $3.26 billion, higher than consensus of $3.21 billion.

Engility Holdings (EGL +1.40%) has been selected as a prime contractor for a potential $68 million contract to support Navy computer networks ashore under a contract with the Space and Naval Warfare Systems Center Pacific.

Life Technologies (LIFE -0.08%) reported Q2 EPS of 98 cents, better than consensus of 96 cents.

Con-way (CNW +2.47%) reported Q2 adjusted EPS of 67 cents, beter than consensus of 59 cents.

Williams (WMB +1.06%) reportED Q2 adjusted EPS OF 19c, better than consensus of 15 cents.

Lam Research (LRCX -0.95%) reported Q4 EPS of 80 cents, stronger than consensus of 71 cents.

MetLife (MET +0.39%) reported Q2 EPS of $1.44, better than consensus of $1.33.

Allstate (ALL +0.14%) reported Q2 EPS of $1.12, well ahead of consensus of 98 cents.

Whole Foods (WFM -0.07%) reported Q3 EPS of 38 cents, better than consensus of 37 cents, and raised its 2013 EPS view to $1.45-$1.46, higher than consensus of $1.45.

CBS (CBS +0.97%) reported Q2 EPS of 76 cents, stronger than consensus of 72 cents.

Earnings from seekingalpha.com…

Notable earnings before today’s open: ABMD, ABX, ACOR, ADP, AEE, ALE, AMAG, ANSS, APA, ARNA, ATK, AUXL, AVP, AZN, BCOR, BDBD, BDX, BGCP, BZH, CAH, CCJ, CHK, CI, CLX, CME, CNP, COP, COV,CVI, CVRR, DTV, ELNK, ENB, EPD, EPL, FCH, FIG, FLR, FLY, GEL, GIL, GWR, HCA, HGG, HK, IIVI, INCY, IRDM, IRM, ITT, IVR, K, LKQ, MMP, MNTA, MPC, MPLX, MT, MWW, MYL, NGLS, NIHD, NILE, NNN, NUS, NYT, OCN, PDCE, PG, PKD, PPL, PRLB, PWR, Q, SBH, SCG, SFY, SHOO, SNE, STRZA, TDC, TE, TEVA, TWC, UAN, VICL, VMC, VPHM, WLT, WNR, WPX, WWE, XEL, XOM, XRAY

Notable earnings after today’s close: ACLS, ACTV, ADNC, ADUS, AHS, AIG, AIV, ALSK, AREX, AVG, BBG, BERY, CCO, DCT, DXPE, EIX, ELLI, EVC, EXR, FEIC, FLT, FRT, GMED, HME, HTGC, KOG, KRFT, LBTYA, LEAP, LF, LNKD, LRE, MELI, MHK, MOVE, MRC, MTZ, ONNN, OPEN, OPTR, PACB, PKI, PSA, QTM, RMD, SBAC, SKUL, SREV, SSNI, SWN, SYNA, TLAB, TS, TSO, TTMI, VCLK, VPRT, WTW, WWWW, ZAGG

this week’s Earnings

this week’s Economic Numbers

today’s upgrades/downgrades

0 thoughts on “Before the Open (Aug 1)”

Leave a Reply

You must be logged in to post a comment.

The Fed is done for now, but not forever. The after affects are visible in Japan (down when US stays easing), ECB (no change, but promised turn up end of year), China (things are soft, on the other hand who knows). Futures up 106 in Dow and 12 SP. Europe buys and we go up. Ride the index etfs up, Keeping my puts, avoiding bonds, and keeping an eye on gold to reach for 1385. GDX is the vehicle. Have we been here before?

yes……. 1.5 Billion People !

Man this bull is powerful.

Update on target: steady as she goes, Fibs indicate ES will hit 1737 // SPX 1742.

Europe close on its exhaustion highs at resistance

dax 8410–ftse 6681

i say down forever

waiting for a break of piviot to short

the big boy instos are selling into strengh as per my 2 minute tick indicator

with the majority of volume going on below the nutral zero line

but no negative tick extrems yet,below the minus -1000 line