Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed and with a lean to the upside. India rallied 2.2%, Hong Kong, South Korea and Taiwan around 1%. Europe is currently mostly up. France, Stockholm, Italy, Greece and the Czech Republic are doing the best. Futures here in the States point towards a flat open for the cash market.

The dollar is up slightly. Oil and copper are up. Gold and silver are up.

Yesterday was the market’s best day since just before the top in early August. The indexes posted across-the-board gains, most groups rallied and a few indicators improved. It was a step in the bull’s direction, but there are still some negative forces lingering. There are a few indicators that haven’t moved to extreme levels and others which haven’t reversed. And of course Syria still looms as a potential market mover.

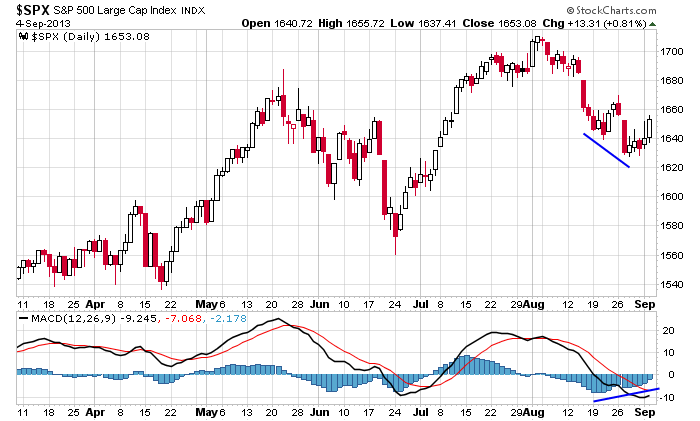

Here’s the S&P daily. Sometimes a good or bad day can change your perspective, so it’s important to back up and remind yourself one day means nothing. The overall trend is up, the shorter term trend is down. And you only have to go back to the last mini correction in June to be reminded big up days occur within downtrends.

Today is a Jewish holiday, so the volume is likely to be on the lighter side.

Stock headlines from barchart.com…

Sherwin-Williams (SHW +0.74%) was upgraded to “Buy” from “Neutral” at Longbow.

The NY Times reports that President Obama prefers to nominate Larry Summers as the next Fed chairman.

Lockheed Martin (LMT +0.52%) was downgraded to “Sector Perform” from “Outperform” at RBC Capital.

Newmont Mining (NEM +0.48%) was downgraded to “Equal Weight” from “Overweight” due to valuation at Barclays.

Viacom (VIAB +0.24%) was downgraded to “Neutral” from “Buy” at B. Riley.

JoS. A. Bank (JOSB +0.33%) reported Q2 EPS of 51 cents, lower than consensus of 52 cents.

Transocean (RIG +0.15%) was upgraded to “Outperform” from “Neutral” at Credit Suisse.

POZEN (POZN +1.34%) jumped jumped 13% in after-hours trading after it announced it had signed a commercialization agreement with Sanofi (SNY +0.63%) .

Greif (GEF +3.27%) reported Q3 EPS of 80 cents, below consensus of 89 cents.

Raging Capital reported a 12.5% passive stake in Standard Register (SR +17.27%) .

Starbucks (SBUX +0.75%) was initiated with an “Outperform” at Wedbush with a price target of $80.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Today’s economic calendar:

Chain Store Sales

7:30 Challenger Job-Cut Report

8:15 ADP Jobs Report

8:30 Initial Jobless Claims

8:30 Productivity and Costs

9:45 Bloomberg Consumer Comfort Index

10:00 Factory Orders

10:00 ISM Non-Manufacturing Index

10:30 EIA Natural Gas Inventory

11:00 EIA Petroleum Inventories

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: CONN, JOSB, TITN

Notable earnings after today’s close: AMBA, BLOX, COO, FNSR, PAY, SWHC, ZQK, ZUMZ

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 5)”

Leave a Reply

You must be logged in to post a comment.

Spy engulfing candle wednesday may indicate a short term low in place. Anyway, own a few calls since this is likely a good positive jobs report Friday 180 -200,000 which will drive the traders. Gold down to 1300-1320, then a reversal maybe is possible. Don’t underestimate the problems with the budget CR and the debt ceiling. The prospects still on a index buy for a while longer but when Congress convenes no man nor cow is safe. Sorry you knew that.

Where did the bullishness come from yesterday?????

Agree w/ Neal re: short covering. Who knows why, but once S/covering starts, hard to stop it. Lotsa bears out there after this drop.

Don’t forget that spx 1630 is major support. We broke S/T resistance ye’day, strengthening that support. At least for the time being.

There is significant resistance above at 1662 extending to 1675. Breaking those levels, a target above 1700 comes into play. If those levels hold, a target in the low 1600s is in play.

Never straight up or down, will always be retracements.

News still will move the market.

Have a good day.

I said things are improving.

I’m a technical trader. Only an idiot would dig his feet in and defend a viewpoint when the market changes.

Neal,

ur technical indicators–dead cats gruesome and awesome ,need some brandy to keep them bounceing

otherwise send them back to ur modleing school

no trend—choppy distribution