Good morning. Happy Tuesday. Happy Birthday Leavitt Brothers (one day late). Perhaps I’ll make a special offer later this week or over the weekend.

The Asian/Pacific markets closed with across-the-board gains. India and Indonesia rallied almost 4%; China, Malaysia, Japan, Singapore and South Korea rallied 1% or more. Europe is currently up across-the-board. France, Germany, Amsterdam, Stockholm, Switzerland, London, Greece, Czech Republic, and Spain are doing very well. Futures here in the States point towards a relatively big gap up open for the cash market.

The dollar is up. Oil is down, copper up. Gold and silver are down.

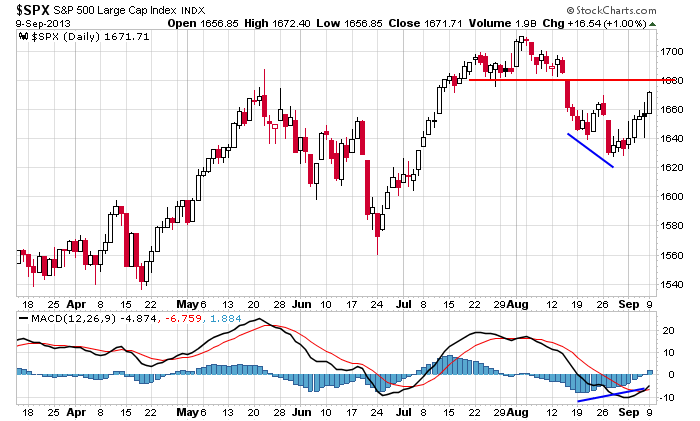

Yesterday the market put in one of its best days since July. The S&P has now rallied 9 of the last 12 days and 5 in a row. I’m not going to say we’re in full-blown rally mode, but there definitely has been a change of sentiment the last week.

The scenario I painted at the end of last week is playing out…that is that the failure of the bears to completely take control implies they either aren’t as strong as some think or the bulls aren’t ready to give in. In either case, I stated if the bears couldn’t push prices down, they’d likely be trapped and get the you-know-what squeezed out of them (again).

This is exactly what has happened. Bearishness had grown for various reasons (Syria, September, tapering, and other reasons), but failure of the bears to really take control put them in a bad situation. They loaded the boat with shorts and pounded their chests that this time really is different, and the next thing you know, the S&P is 50 points off its low.

You gotta love Wall St. When what is ‘supposed’ to happen doesn’t happen, look out. The odds of a big move in the opposite direction jump.

Here’s the S&P daily. Today’s open will be near 1680 – support from July and August. From a technical standpoint it makes sense to rest here, but if the shorts aren’t done covering, a rest may not happen.

Stock headlines from barchart.com…

Jabil Circuit (JBL +1.65%) was upgraded to “Strong Buy” from “Buy” at Needham.

Interfax reported that Syria has accepted Russia’s proposal on chemical weapons.

Marvell (MRVL +4.23%) was upgraded to “Overweight” from “Neutral” at JPMorgan.

Marathon Petroleum (MPC -1.75%) was downgraded to “Neutral” from “Outperform” at Credit Suisse.

Reuters reports that Apple (AAPL +1.60%) today is expected to introduce a cheaper version of the iPhone.

Northrop Grumman (NOC +0.42%) was awarded a $219.15 million government contract that involves foreign military sales to Saudi Arabia.

PG&E (PCG +0.27%) said it will take a $110 million charge in Q3 to settle the claims of substantially all of the remaining plaintiffs who sought compensation for personal injury and property damages related to the rupture of one of the utility’s natural gas transmission pipelines in San Bruno, California on September 9, 2010.

Gabelli reported a 5.22% stake in Leap Wireless (LEAP +0.06%) .

Pep Boys (PBY +1.68%) reported Q2 EPS of 10 cents, well below consensus of 19 cents.

SAC Capital reported a 8.1% stake in Clearwater Paper (CLW +0.43%) .

Five Below (FIVE +3.93%) reported Q2 EPS of 11 cents, better than consensus of 9 cents.

Casey’s General Stores (CASY +1.49%) reported Q1 EPS of $1.43, stronger than consensus of $1.26.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 NFIB Small Business Optimism Index

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

10:00 Job Openings and Labor Turnover Survey

1:00 PM Results of $31B, 3-Year Note Auction

Notable earnings before today’s open: none

Notable earnings after today’s close: CWTR, LCI, RH

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 10)”

Leave a Reply

You must be logged in to post a comment.

How quickly we forget. Ahead is the heavy hauling in national finance.

Futures solidly broke overhead resistance overnight.

Would not be bearish about a pullback to Spx 1660-ish.

Below 1650 would be bad news for this bullish move.

Tgt of SPX 1700 and higher indicated. Will zig zag getting there.

Trading is not investing. Trading is a business. Businesses have expenses.

Software is free. Charts are free. Data feeds are free. A computer can be used for many years and is used for other purposes. A traders only expenses are commissions and a couple subscriptions. Leavitt Brothers saves you time. You can do hours of research everyday or let LB do it for you. Time is much more valuable than a few bucks every month.

I have one comment for you Neal. You’re an idiot!

Neal…people have a right to try even though the odds are stacked against them. How much does an MBA cost…then you find out they’re a dime-a-dozen. The odds are against anyone becoming a full-time profitable trader, but the risk/reward is very favorable. If you don’t make it, you lose some money. If you make it, you make hundreds of thousands of dollars every year for life. It’s worth a try. Investing is for those how already have a lot of money and just want to earn some dividends.