Good morning. Happy Wednesday. Happy Fed Day.

The Asian/Pacific markets closed mixed. Indonesia dropped 1.2%, Japan rallied 1.4%. Europe is currently mostly up. France, Germany, Italy and Spain are leading. Futures here in the States point towards a slightly positive open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are down.

Today is Fed day – it’s the only thing that matters. Technicals don’t matter today. Breadth indicators don’t matter. News trumps the charts, and for this one day, the Fed is in control.

The market expects the Fed to taper their bond purchases by $10 billion. This is a relatively small amount compared to their total activity, so it’s more symbolic than anything else. It means this is the beginning of the end for QE, and although it will take many months to wind down, a new direction will be established (unless they unexpectedly decide not to taper). Rates on the other hand will be kept low for 2-3 more years. Crazy.

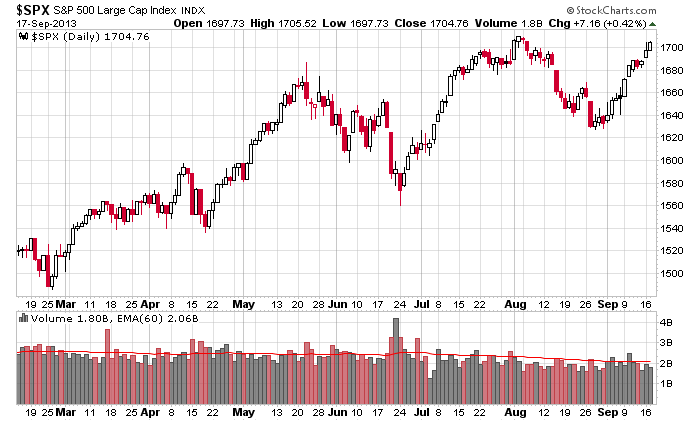

Here’s the daily S&P heading into today’s announcement. The trend is up, the swings are wide. The index has moved up 10 of the last 11 days, so the Fed better not disappoint.

Sit back, relax. Unless you are an active day trader, it’s best to sit on your hands today.

Stock headlines from barchart.com…

FedEx (FDX +1.01%) reported Q1 EPS of $1.53, stronger than consensus of $1.50.

General Mills (GIS +0.10%) reported Q1 EPS of 70 cents, right on expectations, although Q1 revenue of $4.37 billion was slightly higher than consensus $4.29 billion.

Nokia (NOK +0.48%) was upgraded to “Outperform” from “Neutral” at Credit Suisse.

Procter & Gamble (PG -0.41%) was downgraded to “Equal Weight” from “Overweight” at Barclays.

Acuity Brands (AYI +3.18%) was downgraded to “Neutral” from “Buy” at UBS due to valuation.

Consolidated Edison (ED +0.31%) was upgraded to “Neutral” from “Sell” at Goldman.

Caterpillar (CAT -0.13%) was downgraded to “Neutral” from “Outperform” at RW Baird.

Exelon (EXC +0.40%) was downgraded to “Sector Perform” from “Outperform” at RBC Capital.

Five Below (FIVE +2.30%) fell over 3% in after-hours trading after it filed to sell 7.1 million shares of common stock.

Adobe (ADBE unch) reported Q3 adjusted EPS of 32 cents, lower than consensus of 34 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Housing Starts

10:30 EIA Petroleum Inventories

2:00 PM FOMC Announcement

2:00 PM FOMC Forecast

2:30 PM Bernanke Press Conference

Notable earnings before today’s open: CBRL, FDX, GIS, MANU

Notable earnings after today’s close: ORCL, SCS

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 18)”

Leave a Reply

You must be logged in to post a comment.

even as a daytrader i would not trade this till open of asia tomorrow,unless real quick but before being flat at 2 pm

instos have been selling this strength ,but know already what the fed is going to do

so if bad news they should push it higher before 2pm to sell at higher levels

quad witch fri will trump uncle ben of fed as instos dont like paying out on opt premiums ect

still in china so i will probably stay flat till next week

We know a reduction in bonds must come and now may be as good as any time, BUT we should fear the budget and debt ceiling since there is real contention about both. The government may not be able to spend new program money (20% of GDP) but welfare,SS and pensions go on. Like death they are unavoidable. A nasty or disgusting deal are coming very soon which will be papered over like cracks until the house collapse. Opps I am trying to be positive.

In the long run the economy is slowing (my take not the BEA’s which sees 2% growth and 1.5 inflation so maybe .5% growth and falling. Christmas looking bad to awful.(10-20% of retail sales come a year end)

Fundamentals: when GDP totals, are exceeded by total market value: {GDP < Total stock Mkt value} = step aside. The market is overvalued and will correction. How much? 10-20% is possible. Beware and be conserving for a while is my motto for this month, hell, maybe the whole rest of the year. You may have a bad day or 3&4 quarters.

Yes the debt ceiling will be nasty.

Collar Friday options.